OUR THINKING

RESEARCH & THOUGHT PIECES FROM OUR TEAM

Investors embraced risk throughout 2023, as they speculated that the Federal Reserve (the Fed) would pivot from their tightening stance that has been in place since March 2022, to one of easing. From a stock market perspective, the year can be summarized in two words: Magnificent Seven (aka Mag Seve...

Watch Managed Asset Portfolio's monthly roundtable as our Investment Team takes a look back at the markets during 2023. The team reviews the impact of the Magnificent Seven, market timing, and the importance of keeping a long-term perspective. Finally, the team discusses the impact of the Federal Re...

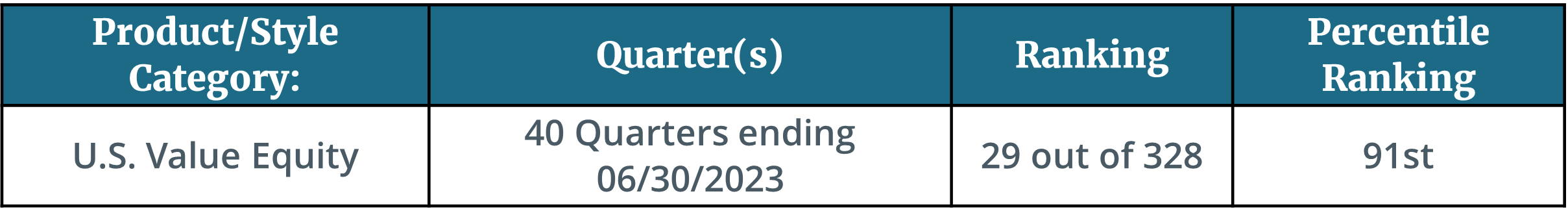

MAP U.S. Multi-Cap Value Strategy

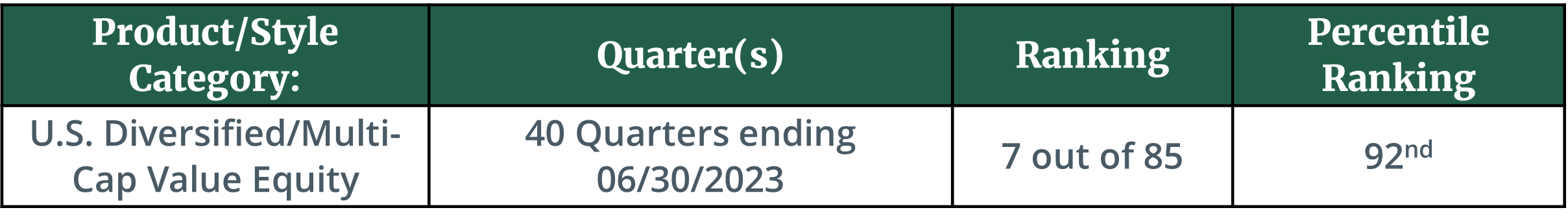

MAP Balanced Strategy

“Our strong long-term relative performance speaks to our team's ability to navigate through global economic triumph and turbulence during full market cycles. It also underlines the importance of diversification. This is driven by our proc...

Watch Managed Asset Portfolio’s monthly roundtable as our Investment Team discusses investment implications from the Middle East tragedies and how best to navigate through these times.

We have often discussed the risks inherent in market timing. While in the past we have centered these discussions around the stock markets, the same holds true for other asset classes. As a reminder, market timing entails making buy or sell decisions based on predictions of short-term market price m...

Stock prices moved lower during the third quarter of 2023 as progress on the inflation front slowed, and investors began to digest the likelihood of more interest rate hikes. As we have noted in previous MAP Views, we believe it will be challenging for the Federal Reserve (the Fed) to guide inflatio...

Watch Managed Asset Portfolio’s monthly roundtable with our Investment Team discussing the latest market news and trends. Topics include interest rates, inflation, our current fixed income positioning, and the potential impact from a government shutdown. This is an excellent opportunity to hear from...

During the firm’s two-decade-plus history of managing global portfolios, we cannot begin to count how often clients and prospects have questioned us on our avoidance of purchasing mainland China stocks. Clients often cite a vast population, growing middle class, and "cranes in the skylines" to suppo...

MAP U.S. Multi-Cap Value Strategy

“Our strong long-term relative performance speaks to our team's ability to navigate through global economic triumph and turbulence during full market cycles. This is driven by our process, deep intellectual capital and a portfolio management team who has been t...

While still lingering in the air of an unkept house, the dust has seemingly settled following the banking panic earlier this year, which saw the collapse of the European banking giant Credit Suisse, and the 2nd, 3rd, and 4th largest bank failures in U.S. history. Credit Suisse’s failure would more a...

Watch Managed Asset Portfolio’s monthly roundtable with our Investment Team discussing the latest market news and trends. Topics include the most recent quarterly earnings, the economy, and the current state of the stock market. This is an excellent opportunity to hear from our team and get their la...

Life is not linear; you have ups and downs. It's how you deal with the troughs that defines you. Much like life, performance measurement is a process, not an event. It's a flowchart, not a checkbox. As a long-term value manager, we have specific processes in place geared towards generating attractiv...

CONNECT WITH US

Subscribe to our mailing list to stay connected with our investing insights, webinars and latest news.

Managed Asset Portfolios, LLC is registered as an investment advisor with the United States Securities and Exchange Commission (SEC). Registration as an investment advisor with the SEC is not an endorsement and does not imply any level of skill or training.

Managed Asset Portfolios, LLC claims compliance with the Global Investment Performance Standards (GIPS®). To obtain a compliant performance presentation and/or the firm’s list of composite descriptions please click on the Contact Us portion of this website, or call us directly at (248) 601-6677.

For additional detailed information about Managed Asset Portfolios, LLC including fees, services and other important information, please carefully read our current Client Relationship Summary (ADV Part 3) and Disclosure Brochure (ADV Part 2A) before you invest.

This website does not constitute an offer or recommendation by Managed Asset Portfolios, LLC of any securities, or an offer of services to any person residing in any jurisdiction in which such solicitation would be unlawful under the applicable laws and regulations. Managed Asset Portfolios, LLC complies with the notice filing requirements imposed upon SEC-registered investment advisors by those states in which the firm maintains clients, or qualifies for an exemption or exclusion from the notice filing requirements.

The website is limited to the dissemination of general information pertaining to investment advisory services provided by Managed Asset Portfolios, LLC. The information reflected on this website should not be construed as personalized investment advice and should not be considered as a recommendation for any specific investment product, strategy, or other purpose. For more information, please see Terms of Use which governs your use of this website.

Please don't hesitate to Contact Us if you have any questions.

This website uses cookies. For more information please see the website Privacy Policy.