Tax-Loss Harvesting - MAP's Approach

Nov 18, 2022Tax-Loss Harvesting

Investors may be hard-pressed to find positive-performing investments in their portfolios in 2022, a year that has seen the worst equity performance since the Global Financial Crisis, and the most severe bond market decline in almost half a century. While no one enjoys seeing negative returns, tax-loss harvesting allows investors to, at least in some form, mitigate their tax burden. Tax-loss harvesting can enhance after-tax returns by utilizing the sale of a security at a capital loss to offset the sale of a security at a capital gain. When done correctly, it mitigates the tax burden for investors in the current tax year, and potentially future tax years.

Short-Term Versus Long-Term Investments

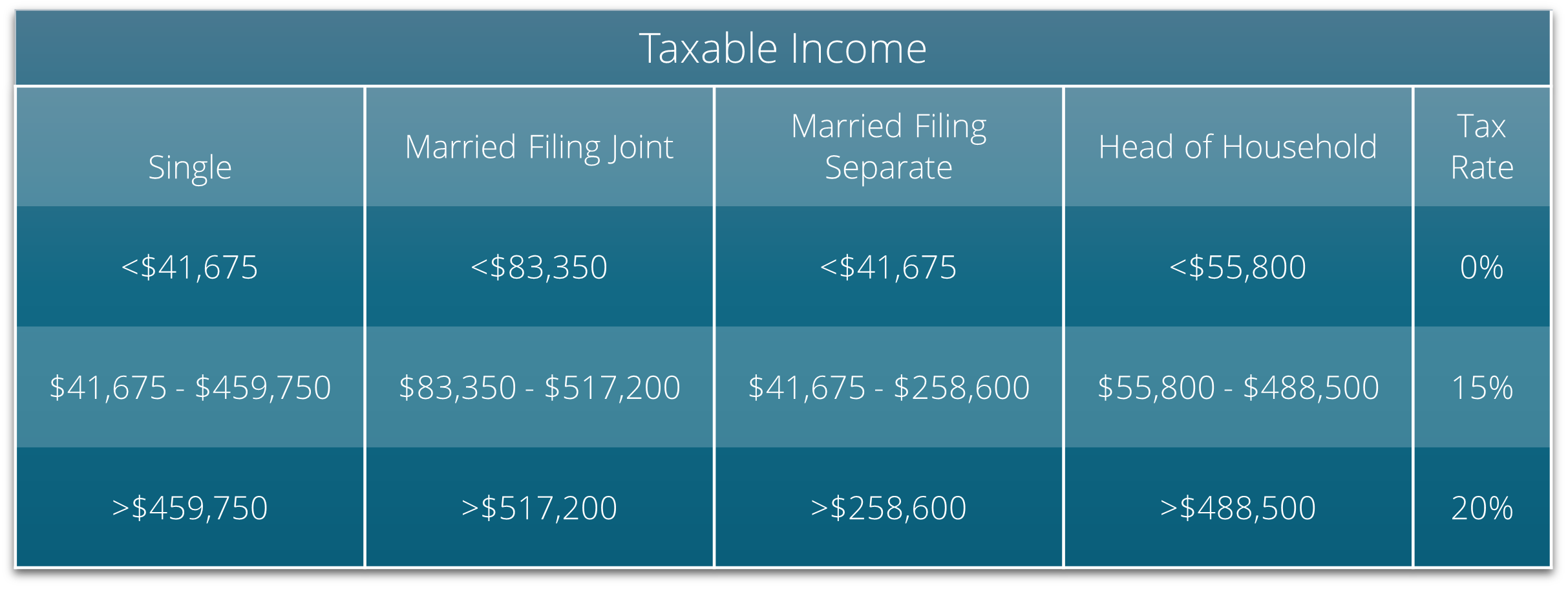

Before delving into the specifics of tax-loss harvesting, it is important to understand the differences between short-term and long-term investments and how they are used to determine an appropriate tax-loss harvesting strategy. To start, selling an investment at a capital gain increases your tax burden, while selling at a capital loss mitigates it. Investments can be classified into two categories: long-term investments and short-term investments. Long-term investments are investments that are bought and then sold after one year or more of ownership whereas short-term investments are investments bought and sold before a one-year holding period. Short-term investments are taxed as ordinary income while long-term investments are taxed at a different rate, as outlined in the table below. Tax brackets are likely to change year-to-year and the brackets for the year 2023 are increasing next year.

Taxable income and tax rate numbers obtained from the Internal Revenue Service. Data is for the year 2022, with taxes due in April 2023, October 2023 with extension. Excludes state taxes. Individuals with significant investment income may be subject to the Net Investment Income Taxes (NIIT). For additional information on capital gains tax rates and the NIIT, see a qualified tax advisor.

What is Tax-Loss Harvesting?

Now that we understand the difference between short-term and long-term, we can dive deeper into tax-loss harvesting and Managed Asset Portfolio’s (“MAP’s”) perspective. Tax-loss harvesting is a strategy that aims to enhance after-tax returns on investments by offsetting realized gains with realized losses. When done properly, tax-loss harvesting allows investors to mitigate tax burdens at the end of the year.

As a default, MAP uses the widely accepted accounting method known as First-in First-Out, or FIFO, unless directed otherwise by the client. While the best method will vary for each investor depending on their type of gain, ultimately FIFO is the method that minimizes the tax bill with the least amount of sacrifices to long-term performance and portfolio structure. These subtle yet effective differences make a sizable impact on the overall strategy an investor takes. Tax-loss harvesting helps investors benefit from bear markets by offsetting the tax burden, enhancing after-tax returns. Any investor with a taxable account can take advantage of tax-loss harvesting. Tax-loss harvesting has become exceedingly popular and is considered one of the greatest tools in an investor’s toolbox.

Special Considerations for Tax-Loss Harvesting

Although tax-loss harvesting is widely utilized by investors, conditions and exemptions should be considered. If the trading cost for an investment outweighs the tax benefits, investors should not use tax-loss harvesting. Retirement accounts do not qualify for tax-loss harvesting as they have their own tax benefits. The most tax-efficient approach is to sell losses to reap tax benefits when an investor realizes short-term gains during the year. It’s also worth noting that an investor who reports a lower taxable income will not benefit as much as an individual with a higher taxable income.

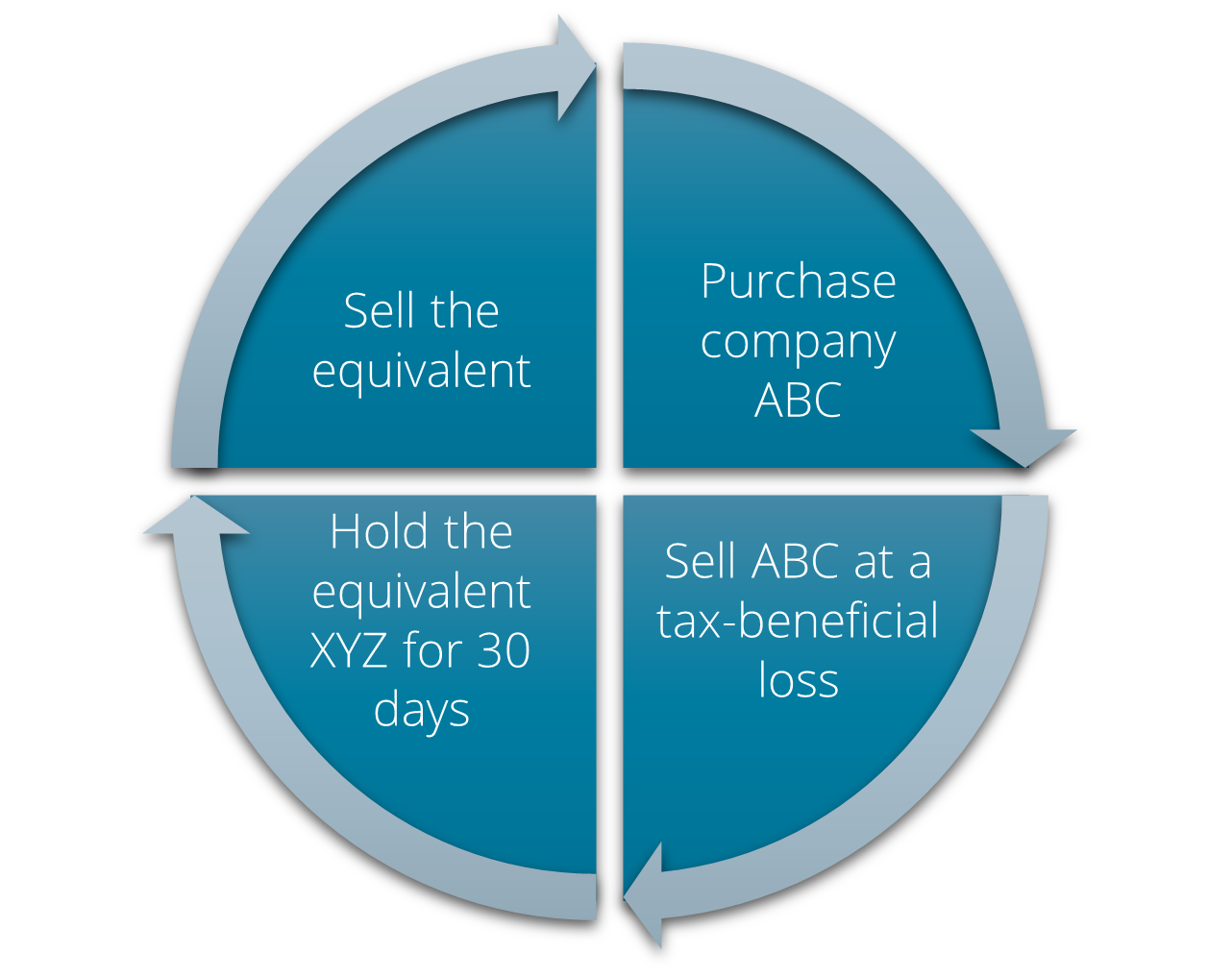

Another consideration that investors must be aware of while executing a tax-loss harvesting strategy is the Wash Sale Rule, which regulates the sale of an investment at a loss coupled with an immediate buyback of that same investment within a 30-day window. For example, an investor cannot sell shares of company ABC at a capital loss then immediately buyback the shares. If this occurs, then the tax-loss harvest benefit is negated. Note that the Wash Sale Rule still applies if the investment was traded in an IRA. Additionally, an investment cannot be sold in an individual account, then repurchased in an IRA during the 30-day period; doing so will trigger a violation of the Wash Sale Rule. Navigating the Wash Sale Rule is tricky because it alters the structure of an investor’s portfolio, but there are ways around the Wash Sale Rule that investors and firms, such as MAP, utilize.

When selling a position at a loss for tax purposes, we may use a temporary “substitute” for that investment until the 30-day period ends. To do this, we measure the correlation of an investment with a different, but similar, investment. We look at factors such as the R2, industry, type of security, beta, and risks of the substitute investment. Conversely, we may increase the weighting in one of our existing positions after the sale of a security to maintain a similar risk-to-reward portfolio structure.

For example, MAP wants to sell company ABC at a 30% short-term loss. We cannot buy back company ABC for 30 days, but we notice that company XYZ is highly correlated with ABC. For the 30-day period, MAP will purchase XYZ with the cash obtained from the sale of company ABC, assuming we have already considered the advantages/disadvantages of keeping the proceeds in cash for 30 days. After the 30-day period is over, MAP will sell company XYZ and buyback company ABC to maintain the structure of the investment model while reaping the tax-loss harvesting benefits. At MAP, we take approaches that suit our client’s best interests.

Takeaways

Tax-loss harvesting is a tried and tested strategy used by investors to lower tax burdens, making the best of a less-than ideal situation. Investors are always seeking out efficient ways to boost their after-tax returns and lessen any tax burdens they may encounter. At MAP, we take an efficient approach to tax-loss harvesting that goes beyond simply selling out of losing positions, unless of course we determine the risk/reward benefit isn’t appropriate. Any investor can benefit from tax-loss harvesting, but the ones with the highest income tax bracket reap the most rewards.

We welcome your comments on this piece and would be happy to provide more detail on our thoughtful, research-driven investment process. For further information, please email us at [email protected].

Managed Asset Portfolios does not give tax advice to clients. Clients should reach out to their tax advisors for specific information regarding their overall tax situation.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

November 2022

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein does not represent a recommendation by us to buy or sell any security or securities. Managed Asset Portfolios, our clients and our employees may buy, sell, or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change. Past Performance is no guarantee of future results.