Why Global

Sep 14, 2021As investors, we know the world is more interconnected than ever before. Social media allows us to connect with people from all over the globe: Zoom enables seamless video communication anywhere there is a data connection: Apple and Google have created platforms that put endless amounts of information at our fingertips. However, even with this connectivity, many investors stay rooted in their home country's stock investments. In behavioral economics, this is called the home country bias, and to an extent, it is understandable. After all, investors are familiar with their country's economic condition and the companies that drive commerce. As Peter Lynch once advocated, "Invest in what you know." The problem is that advice was given in the early 1990s when the internet was still in its infancy and many markets worldwide were fairly closed off to foreign investors. Not so today. The investing environment today is global and available to anyone with an internet connection.

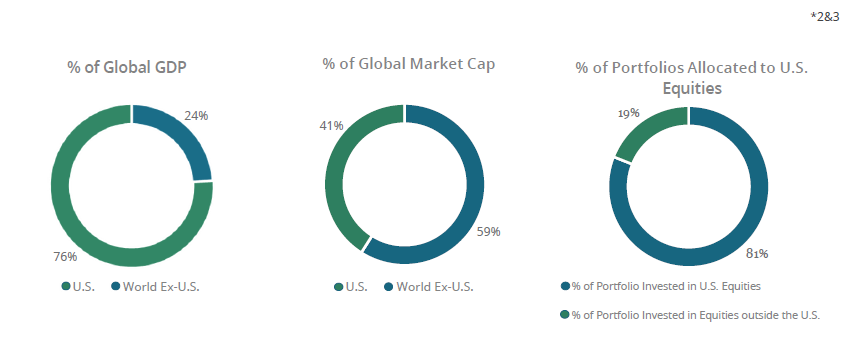

Now that foreign markets have become so accessible, we believe investors can find alpha and diversification in international and emerging markets. The U.S. currently represents 24% of global GDP, but it represents 59% of market capitalization in the MSCI ACWI. As developing markets further industrialize and globalize and developed international markets technologize, we believe there are opportunities for this dichotomy between GDP and market cap to tighten over time. As this plays out, countries worldwide will develop their domestic champions and global leaders, rewarding shareholders along the way. In fact, over the past ten years, non-US stocks have accounted for more than 75% of the top 50 performing individual securities.[1] This is why we are fervent supporters of global investing here at MAP and believe it is the most significant advantage offered to our clients. As global investors, we can invest wherever the value is.

Let's start with the basics. When U.S. markets are expensive, home-biased portfolios are limited in their options. You can continue to buy extremely expensive companies or start buying "cheap stocks" that probably deserve to be cheap because of poor balance sheets or outdated business models. However, as global investors, we can take advantage of the opportunities that are still available in the U.S. while moving our excess capital to better values in international markets. Furthermore, because a country's economy is cyclical, there will be times when the U.S. market is at an all-time high. Yet, international markets are standard deviations below their historical average price multiples. This fact is especially true right now as COVID-19 has impacted countries around the world with different veracities and has been met with varying policy responses. We believe this imbalance creates opportunities for global investors that will allow them to outperform in the years ahead.

Where Are We Now?

After the COVID-19 selloff in March of 2020, Congress and the Federal Reserve were forced to respond by cutting rates, ramping up quantitative easing, and passing the CARES act. Congress then went on to pass two more large stimulus packages to keep money flowing to the U.S. consumer. Similarly, other central banks also responded forcefully. The European Central Bank added more than €3 Trillion to its balance sheet, and the Bank of Japan added more than ¥144 Trillion to its balance sheet.[4]

However, even with the similarly significant policy responses and arguably better handling of COVID, international developed markets have underperformed the U.S. by a wide margin since March 2020. The MSCI World Ex-USA Total Return Index is up an impressive 56.14%, but that is a more than 21 percentage point underperformance relative to the MSCI USA Total Return Index, which is up 77.61% between March 2020 and July 2021. And while it is easy to get lost in the euphoria brought on by the gains made over the last year—and wanting to ride that momentum—we believe investors are underestimating the risks involved with U.S.-only portfolios.

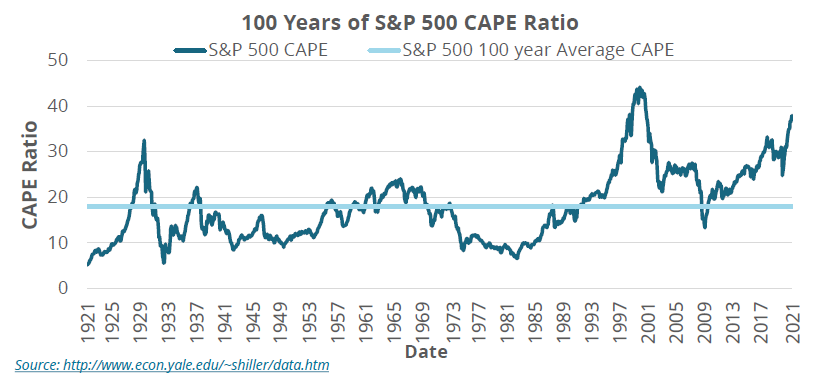

So why do we think there are elevated risks in the U.S. market? It boils down to valuation. If you think about what drives shareholder returns, it's a combination of earnings growth, changes in share count (share repurchases), dividend yield, and multiple expansion or contraction. Today, the S&P 500is at its second most expensive in history with a CAPE ratio of 37.8x, compared to the 100-year average of 18x.[5] So, while in theory, the multiple (CAPE Ratio) could continue to expand and reach the level it did during the dot-com bubble, your investment returns are predicated on a situation that has only happened once in the past 100 years. If you look at just the past five years alone, the CAPE multiple has expanded 38.11% versus a 73.87% change in the real price of the S&P 500.

This means multiple expansion has accounted for more than half of the change in the real price of the S&P 500. If we extrapolate what this means going forward, it highlights the precarious situation surrounding the S&P 500. If the CAPE multiple begins to experience mean reversion, investment returns are likely to suffer as the multiple contraction offsets growth in earnings, dividends paid, and any share repurchase.

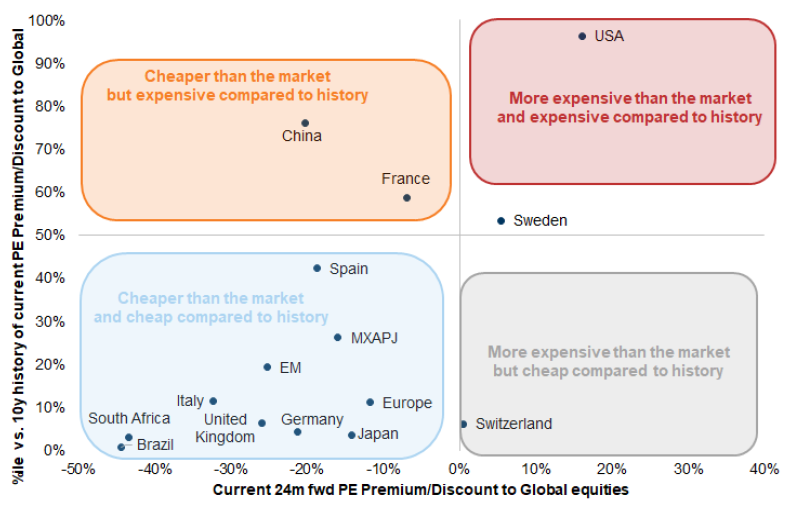

Another way to analyze the valuation of different countries' equities is to compare its forward P/E ratio against a basket of global equities and then compare the current premium or discount to a longer-term average. This type of analysis helps determine if a country is outperforming in isolation or if valuations worldwide have risen in line with one another. When you run this analysis right now, a couple of things stand out, and this chart below does a great job of illustrating it. U.S. stocks are in a class of their own when it comes to valuation and currently have the highest forward P/E premium to global equities than any other country's equities.

Furthermore, its current premium is near the 100th percentile compared to its 10-year historical premium or discount. To put that into perspective, in order for the U.S. to continue to outperform its global peers, its forward P/E premium to global equities is going to need to reach more than 10-year highs.

This is a bet we do not want to put all of our chips on because the data suggests that U.S. markets are poised for underperformance over the next five to ten years, as buying at historically high valuations has resulted in limited upside. This is not to say that opportunities within U.S. markets do not exist, but rather it is in our best interest to capture alpha through other countries' equities. As the chart below illustrates, there are plenty of markets around the world much cheaper than the U.S.

How To Position a Portfolio When U.S. Valuations are Rich

At MAP, we are an advocate for global diversification. We understand that it is not feasible or advisable to shift your portfolio out of U.S. stocks completely. However, we believe those investors with limited global exposure should consider taking some of their chips off the table in the U.S. and begin allocating them into foreign markets, specifically European. We get it. We know what you're thinking, "The U.S. has trounced every market around the world, especially Europe. Their economies are too old school and do not have the fiscal support the U.S. has. Their political conditions are not as stable and do not encourage capitalism, like the U.S. They also do not have the technology exposure that the U.S. has."

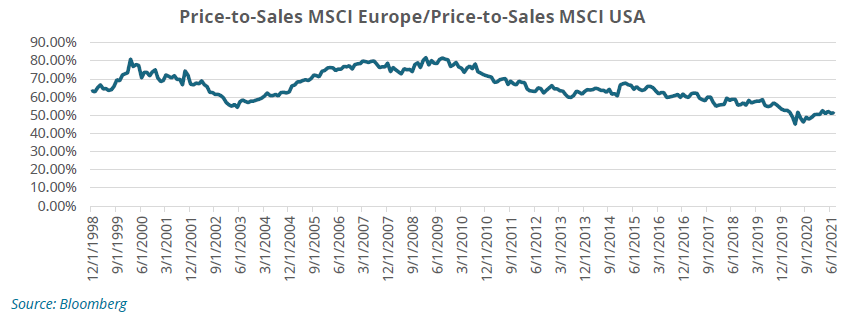

While there are some valid points in that criticism, we also believe that it is overdone—first, the recent shift in the U.S. political landscape. In the past, U.S. markets commanded a premium because of the country's political stability that gave investors a sense of security. Fast forward to the present, and the U.S. finds itself in a very uncertain and contentious environment that could result in additional volatility to a portfolio. As a country's political tides change, so do regulations, trade, and taxation, all of which carry investment implications. Next, let's move to valuation. The MSCI Europe is currently trading at its most significant discount on a P/S basis going back to 1999, the height of the dot-com bubble.

Relative to a benchmark of global equities, its current forward P/E discount is around the 10th percentile of its average premium/discount over the past ten years. Both metrics would indicate a large amount of pessimism relative to their global peers. That takes us to COVID-19 vaccinations. Europe bounced back from a few early road bumps and has handled their vaccine rollout much better than the United States, with a larger percentage of their population fully vaccinated. Many European countries also rolled out substantial fiscal responses, including Spain with fiscal relief equal to 11.2% of its GDP, the U.K. at 9.1% of its GDP, and Germany at 8.4% of its GDP.[6] Lastly, the technology rebuttal; while Europe does not have the index level weighting to technology stocks, there has been an increase in technology companies in the Euro bloc with nearly $24 Billion in venture capital raised in 2020. That is up 6x over the last decade and 1.5x the rate of growth of the United States during the same period.[7] Furthermore, we believe that technology is becoming apart of every company, regardless of industry.

Finding the companies implementing technology solutions such as A.I., machine learning, and automation will be crucial to success no matter which country you invest in. So, acknowledging all of that, we agree that there are some valid criticisms of the Eurozone markets and plenty of reasons why they have under-performed since the Great Recession. However, past performance is no guarantee of future results, and we still believe that valuation matters. Because of that, we are advocating for going overweight Europe relative to a global benchmark because the pessimism has gotten too great and the relative valuation to the U.S. too cheap.

Conclusion

In summary, investors are missing a "world" full of opportunities by restricting their portfolios to only U.S. domiciled stocks. The amount of data and access that U.S.-based investors have to foreign markets eliminates many of the roadblocks that previously existed. Going forward, the opportunity cost of these restrictions can increase quite dramatically in the years ahead as U.S. markets are currently trading near record valuations on both an absolute and relative basis.

The good news is that investors willing to look abroad have attractive options that do not involve increasing your cash position. Europe is currently trading at its most considerable price-to-sales discount against the U.S., going back to 1999.

Also, Europe's forward P/E discount to global equities is around the tenth percentile when looking at the previous ten years' worth of data. This valuation discount and undue pessimism surrounding the European economy make it an attractive option for investors worried about the expensive valuations in the U.S. This belief reflects our positioning here at MAP, where our Global Equity Composite's largest regional over-weighting is Western Europe and where we are finding exciting opportunities.

We recommend that investors analyze the risks of investing in U.S. stocks at these valuation levels in detail and discover the benefits of diversifying their portfolio into global equities, specifically European stocks.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, Zachary Fellows

Research and analysis by Matthew Rasak

October 2021

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent a recommendation by us to buy or sell this security or any other financial instrument associated with it. Managed Asset Portfolios, our clients and our employees may buy, sell, or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change.

[1] https://www.gsam.com/content/gsam/us/en/institutions/market-insights/gsam-connect/2021/Home-Sweet-Home.html

[2] https://personal.vanguard.com/pdf/how-america-invests-2020.pdf

[3] https://globalpeoservices.com/top-15-countries-by-gdp-in-2020/

[4] https://fred.stlouisfed.org/series/M2SL

[5] http://www.econ.yale.edu/~shiller/data.htm

[6] https://voxeu.org/article/fiscal-plans-europe-no-divergence-no-coordination

[7] https://sifted.eu/articles/europe-us-vc/