The Inflationary Impact of Geopolitical Conflicts

Jun 17, 2025Since the turn of the 20th Century, there has been no shortage of global war and conflict for the markets to navigate. With summer approaching, rather than facing the heat of the sun, the markets face the heat of yet another conflict. So far cooler heads have prevailed as the headline risk of the Israel/Iran skirmish has increased. While in its early days, the impetus behind Israel’s attacks on Iran appear centered around debilitating the country’s nuclear program. Our base case does not assume a drawn-out, large scale ground war whereby other countries join the fray en masse; but geopolitical tensions were already heightened before the attacks began. However, as an investment manager, our strong suit is not in predicting war outcomes; but rather, evaluating the bigger picture to determine the potential long-term impacts to the global economy.

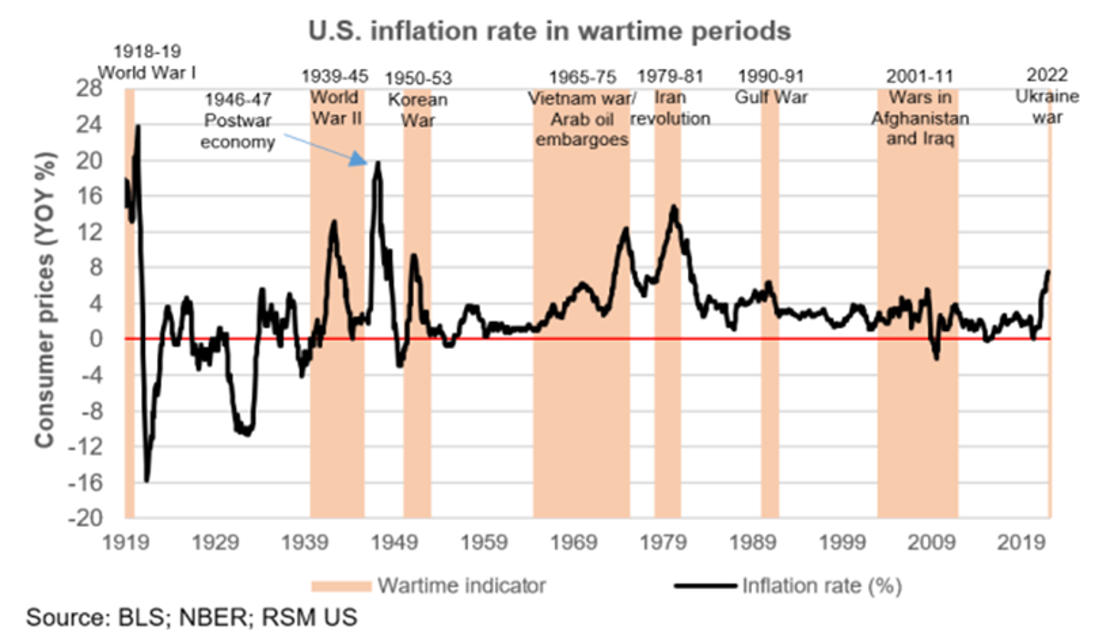

Historically, inflation has often reared its ugly head during times of postwar prosperity, crippling recessions, oil crises, and global pandemics. The amount of inflation felt is determined by the duration and the magnitude of the specific event. Outside of increased government spending during wartime to fund military operations, inflation can make its way through other channels. America’s worst inflation on record occurred during and after World War I, when the price of just about everything—food, clothing, household goods—more than doubled. During World War II, there were shortages of everything: coffee, milk, meat, sugar, canned goods, tires, gasoline and more, driving inflation.

Yet inflation stemming from conflict in the Middle East arrives as a result of distinct factors, specifically affecting oil prices. Historical events like the 1973 OPEC oil embargo and the 1979 Iranian Revolution caused substantial increases in oil prices. Additionally, trade disruptions can lead to supply constraints as cargos are rerouted or even canceled, increasing shipping costs and impacting global trade, leading to higher import and consumer prices. This last point is even more relevant today given the uncertainty surrounding President Trump’s tariffs. Should the U.S. get involved in the Israel/Iran conflict in such a way that it triggers ire on the part of Iran’s allies (specifically China), it could disrupt the outcome of potential tariff agreements.

Despite the uncertainty and volatility created during periods of conflict, the Investment Team has created portfolios that we believe offer investors the necessary diversification to weather the storm. Our equity strategies are overweight those sectors that historically do not require strong economic activity to perform well, including the Consumer Staples, Health Care, and Utilities sectors. They also hold select names in the Materials (including gold) and Energy sectors, as well as select agricultural names that benefit from inflationary periods. Therefore, we do not anticipate making any substantial portfolio changes as a result of the current geopolitical environment.

We encourage you to contact your MAP representative with any questions or concerns.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, Zachary Fellows, John Dalton, and Nicolas Vilotti

June 17, 2025

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent a recommendation by us to buy or sell a particular security or any other financial instrument associated with it. Managed Asset Portfolios, our clients, and our employees may buy, sell, or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change. This content should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice. All investments are subject to risk, including the loss of principal. Past performance is no guarantee of future results.