SVB Financial Group: Echoes From Silicon Valley

Mar 13, 2023Reverberations of the 2008-2009 Great Financial Crisis (GFC) were felt throughout the stock and bond markets as news of SIVB’s demise dominated headlines. In less than 48 hours, Silicon Valley’s largest bank, which was trading over $300 per share just last month, collapsed on Friday morning and was forced into receivership by the Federal Deposit Insurance Corporation (FDIC). The rapidity of SIVB’s failure sent investors fleeing financial stocks, particularly those banks closely resembling SIVB.

The Road To Receivership

SIVB was one of the U.S.’ largest publicly traded banks. Its business focused on servicing the financial needs of technology and biotechnology start-up companies found throughout Silicon Valley. According to its website, it conducted business with nearly half of all U.S. venture capital-backed startups. With venture capital flowing rapidly over the past couple of years, their deposit base swelled from just over $62 billion in 2019 to more than $189 billion by the end of 2021. In an attempt to generate greater returns on these assets, the bank increased its portfolio of longer duration debt instruments which ultimately led to a mismatch between the duration of its long-term investments and its short-term obligations to meet depositor withdrawals. Unfortunately, that previous sharp inflow of deposits reversed as their technology and biotechnology customers withdrew their deposits to fund their young, cash-hungry, businesses.

As SIVB’s customers’ cash needs exceeded the bank’s readily available cash, they were forced to sell long-term debt instruments from their investment portfolio at losses. Why the losses? Since March of 2022, when the Federal Reserve (the Fed) first started hiking rates to the present, short-term rates have risen by 450 basis points. Given the historic pace of rate increases, the value of SIVB’s long-term debt instruments declined and ultimately became insufficient to meet the withdrawal needs of their customers. Early last week, SIVB hired Goldman Sachs to raise capital by attempting a private stock sale, but these efforts failed as rumors of their difficulties began to surface. Early Friday, SIVB’s stock was halted as they attempted to find a well-funded buyer for their entire business – one that could meet the withdrawal needs of their customers. However, like the attempted stock sale, no buyer could be arranged, and they officially failed as the FDIC stepped in to close the bank.

The Fed: Stuck Between A Rock And A Hard Place

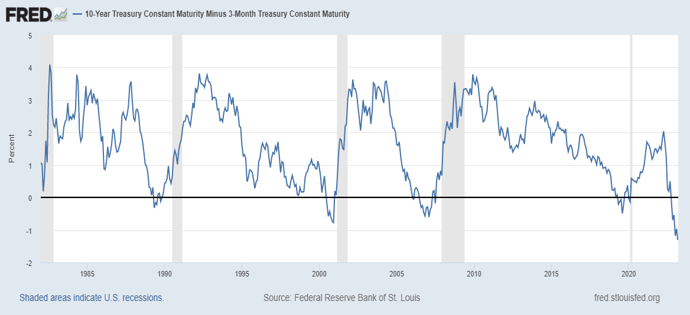

Despite ticking down from peak levels in 2022, inflation picked up again in January. In Congressional testimony last week, investors interpreted Chairman Powell’s language to mean the Fed was open to a quicker pace of hikes. This is in contrast to a slower rate of hikes over their last two meetings. This news of more and faster rate hikes lead to a broad sell-off in stocks. While the Fed will always claim their actions will be data dependent, we believe the risk has always been that they would tighten until something broke, either the economy or the financial plumbing. Until late last week, all eyes were on the economy, with the yield curve having its greatest inversion since 1981 (see chart on page 3). As those occupying a dwelling know, one doesn’t see there is a problem with the plumbing until that problem presents itself. The question becomes, however, is the plumbing fixed or are there bigger problems brewing?

As we have communicated in previous publications, our forecast has been that inflation would remain stubbornly high. We were skeptical of the transitory argument made by the Fed nearly two years ago and still do not see a clear path to the Fed meeting its 2% long-term inflation target. Rather, we continue to believe inflation will be range bound between 3% and 5%. Given last week's events, we think the Fed will increase in 25 basis points increments a few more times before hitting the pause button around mid-year. We note that this view is in line with current market forecasts.

Not All Value Stocks Are Created Equal

After an extended period of underperformance, value stocks have been back in vogue, as once high-flying/high-valuation stocks have come back to earth. We believe this is a factor of investors adapting to an environment of elevated inflation coupled with higher interest rates. Financials constitute a large portion of indices and to most investors are considered the quintessential value stocks. For reference, as of February 28, 2023, Financials comprised 15% of the MSCI All-Country World Index and 24% of the MSCI ACWI Value Index. For comparison purposes, over the same time period, Financials comprise just 3.00% and 2.80% of the MAP Global Equity and MAP Global Balanced Composites’ equity portfolios, respectively. Furthermore, our composites do not hold equity positions in traditional banks or insurance companies. Even in the strategies that purchase bonds, we shun the sector for the most part, despite the fact they tend to be among the largest issuers of debt. Our avoidance of investing in many of the traditional financial companies harkens back to before the GFC, when the first auction rate preferred shares failed. In hindsight, while past performance is no guarantee of future results, that was an excellent call on the part of our Investment Team, as the financial sector bore the brunt of the selling pressure during the GFC. Specifically, from February 2007 through the end of February of this year, the MSCI World Financials Index saw its price fall nearly 12%, or 0.77% annually. And for the five-year period ending December 2022, the MSCI World Financials Index saw its price increase just 2.89%, or 0.57% annually.

Summary

As any prudent investor, we continually look for opportunities, and quite often, the best options come during times of extreme pressure. For now, we are content to sit on the sidelines, positioning our portfolios for future action when we believe it is appropriate. Despite the receivership of SIVB, we do not believe this is the beginning of another GFC. Rather, we consider SIVB as an outlier impacted by its over-reliance on the venture capital space. We do believe, however, that the current interest rate environment will likely put downward pressure on banks' interest rate margins. Furthermore, we believe the impact of bond losses on bank balance sheets combined with a flight of customer deposits away from low interest rate offerings heightens the risk profile for banks. While we currently do not see financial contagion on the horizon, we do believe it will lead to a contraction of interest margins for banks, as they will need to offer higher yields to depositors to retain assets.

We believe last week’s events provide a good opportunity to remind investors of an important distinction about our value-based investment approach. We are not what could be construed as traditional value investors. Instead, we believe in using a multi-faceted valuation process that looks to invest in securities prior to catalyst-driven inflection points. This process allows us to find securities that are not in the typical value universe. With that said, at some juncture, regional banks with strong capital structures to support the losses from their investment portfolios may become compelling investments. Time will tell, and we will be monitoring the situation closely, both for opportunities and risks.

As has been the case since MAP’s inception, we do not manage our clients’ portfolios according to an index. If we like a particular industry or sector, we are not opposed to being overweight. Conversely, if we dislike or have concerns about a sector, we are willing to be significantly underweight or absent.

Please contact your MAP representative if we may be of service or if you have any questions.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

March 2023

Certain statements may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein does not represent a recommendation by us to buy or sell any security or securities. Managed Asset Portfolios, our clients and our employees may buy, sell or hold any or all of the securities mentioned. Managed Asset Portfolios does not have any direct balance sheet exposure to SIVB, nor are any of MAP’s composites invested in SIVB. We are not obligated to provide an update if any of the figures or views presented change. Past performance is no guarantee of future results.