Sometimes We Make History

Mar 11, 2022As MAP president Michael Dzialo notes, “Sometimes history repeats itself, and sometimes we make history.” We are at one of those rare moments when history is being made. Can the Federal Reserve (the Fed) and our free-spending elected officials restrain themselves enough to bring inflation under control, and, if they can, how will equity markets unaccustomed to fiscal and monetary restraint react?

In this thought piece, we’ll review actions taken by the Fed and our elected officials in response to the COVID pandemic, trace the origins of the speculative excesses that investors began to unwind over January 2022 and discuss how MAP is preparing for this new chapter of economic history.

COVID and the ‘Great Flood’

Isolated reports about a concerning new virus in Wuhan began to surface in December 2019. They were primarily dismissed until human-to-human transmission was established in January 2020, a month during which the S&P 500 hit record highs. Even then, it was not until COVID finally reached the United States' shores that the markets began to react. And react they did. The COVID-fueled decline started on February 20, with the S&P 500 experiencing its fastest 30% decline in history, reaching a pandemic low of 2249 on March 23, a fall of almost 35%.

Monetary Response

Drawing from its Great Recession playbook, the Fed reacted forcefully in March, beginning with a half-point cut to the federal funds rate on March 3, followed by a cut to zero on March 15. It announced its intention to maintain the rate at that level until the economy stabilized and the economic threat of the pandemic had passed.

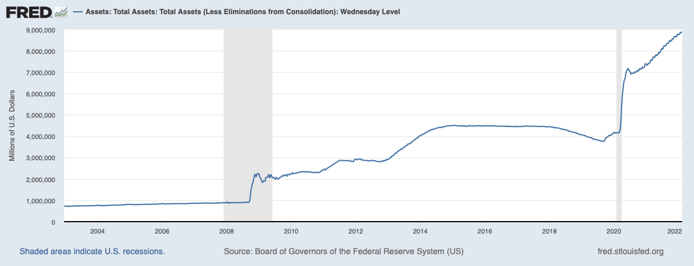

The Fed also established a myriad of programs that shored up credit markets and' flooded' the U.S. economy with cash, adding nearly $5 trillion to its balance sheet in two years compared to the $3.5 trillion added in the five years after the Global Financial Crisis. Among the programs was a first-time initiative of buying corporate debt. The Fed's willingness to purchase new corporate issues, coupled with low-interest rates (in the 3-3.25% range for seasoned Baa bonds), led to private debt swelling from $140 billion in Q3 2020 to $215 billion in Q1 2021. The chart below reflecting the Fed's net asset flows illustrates the Fed's swollen balance sheet's ascent to unheard-of levels.

Fiscal Response

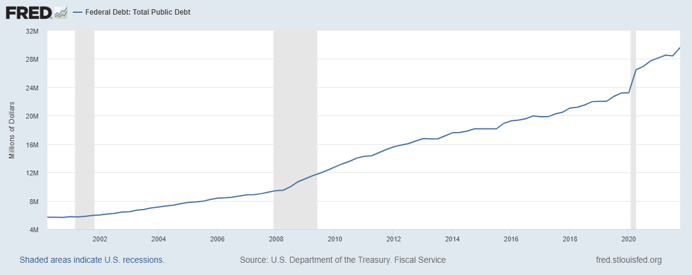

The Fed's aggressive monetary actions were matched by fiscal stimuli from the Trump and Biden administrations. This included the federal government increasing unemployment benefits by $600 per week compared to the $25 weekly increase passed following the Great Financial Crisis. Approximately 478 million stimulus checks were sent out with an expected total cost of $867 billion. This excludes the expansion of child tax credits which increased from a maximum of $2000 annually to $3600 annually. Other stimulative measures included pausing student loans, banning renter evictions, and granting homeowners forbearance on their mortgages, among others. In all, total U.S. Federal Debt increased by more than $6 trillion in two years.

Inflated Valuations, Rampant Speculation

The initial market response was, in hindsight, rational. High-quality companies and technology firms that facilitated working and spending more time at home were the first to benefit. E-commerce giants like Amazon and Best Buy also saw rapid rises in their stock prices. From there, we transitioned from a market that was rationally evaluating the effects of the pandemic and additional liquidity to one that became irrational.

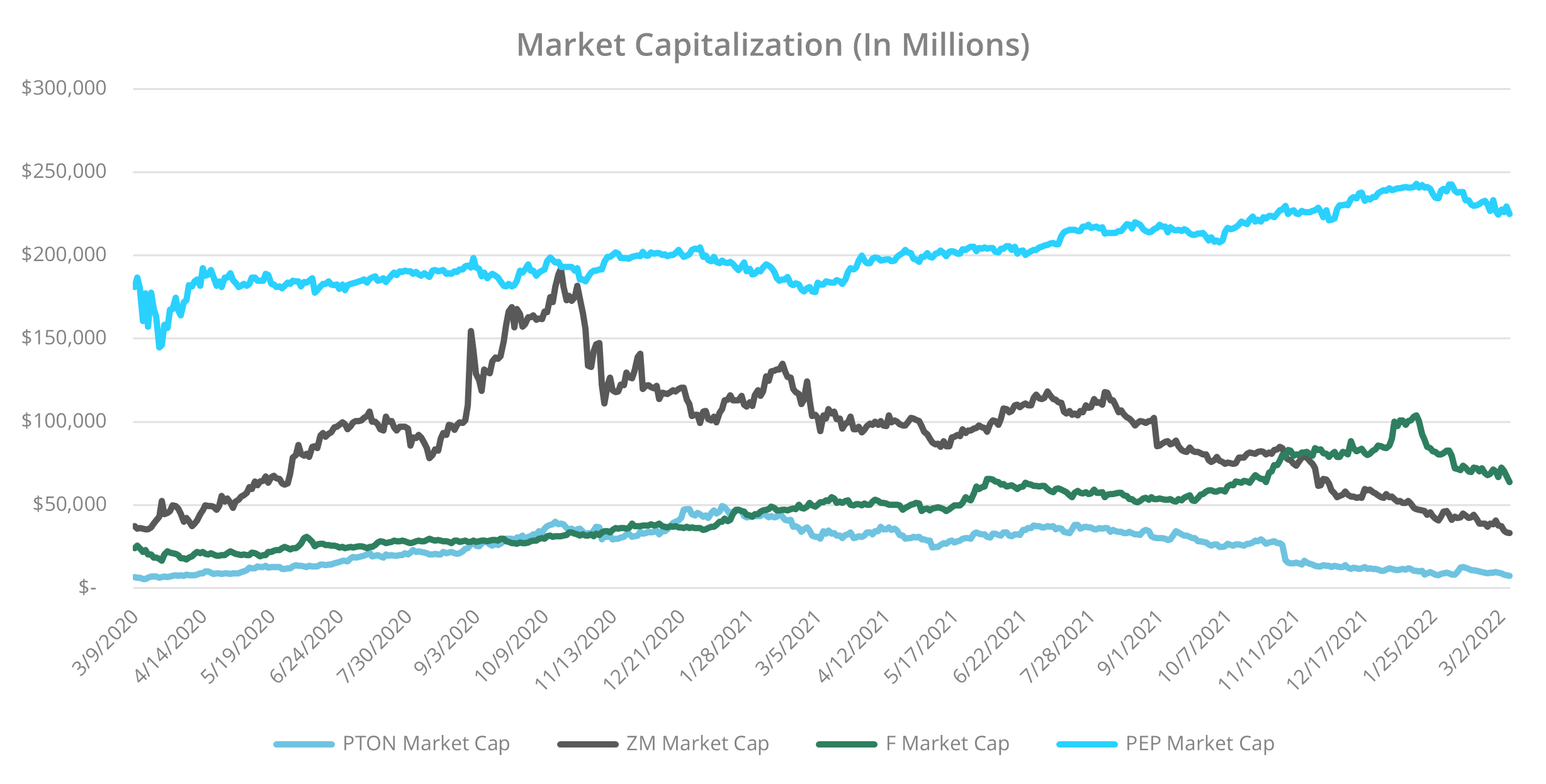

Low-quality, highly speculative investments skyrocketed in price. "Meme stocks" such as GameStop, AMC Entertainment, and Blackberry captivated new investors with Reddit posts that claimed they were "going to the moon" because of "diamond hand" investors who would never sell. Pandemic darling stocks like stationary bike company Peloton reached unfathomable levels. Its peak market capitalization of $49.3 billion surpassed that of Ford Motor Company. And let's not forget about Zoom, whose market cap reached more than $191 billion at one point, putting it nearly in line with PepsiCo ($193 billion). As a reminder, this was for a video conferencing company facing competition from the likes of Microsoft and Cisco, which only generated $1.38 billion in free cash flow. For comparison, Pepsi generated nearly $7 billion in free cash. Altogether, this mania resulted in unprofitable companies within the Russell 3000 having an average return of 71.60% between May 31, 2020, and January 25, 2021. Unfortunately for the rational, the mania spread quickly to other categories with the rise of nonfungible tokens (NFTs), trading cards, sneakers, and cryptocurrencies. It was all eerily reminiscent of the eBay trader collectible fads in the late 1990s. Beanie babies, anyone?

When Tailwinds Become Headwinds

At the beginning of 2021, those trends began to reverse as investors started to price in a new economic environment. Stocks like Zoom and Peloton are each down more than 80% from their respective all-time highs. An index measuring NFT prices is down more than 47% over the past three months (as of March 4, 2022).The Defiance Next Gen SPAC ETF (ticker: SPAK) is down more than 50% from its 2021 highs. At one point in early January 2022, roughly four in every ten companies on the Nasdaq Composite Index were down 50% from their 52-week highs. Given all of that, we do not think we are going too far out on a limb to say that the market environment has changed.

MAP is Prepared for a Challenging Market Environment

However, we're concerned this is only the start of a changing environment for both the market and the economy. And only by realizing the history-making nature of the market environment over the previous couple of years can investors appropriately adapt and adjust their portfolios accordingly. Let's look at how the market environment is set to change.

The equity market's exceptional performance has been supported by four key areas, all of which we believe are set to become headwinds. As we discussed above, the Fed has taken extraordinary actions, buying corporate debt, mortgage-backed securities (MBSs), U.S. Treasuries, and lowering interest rates to zero. All of which is coming to an end. The Fed has already stopped buying corporate bonds, and they are set to engage in Quantitative Tightening (QT) by allowing their assets to roll off their balance sheet while simultaneously raising rates. The last time the Fed did this, they were able to do it in a prolonged and coordinated manner. First, they started tapering their asset purchases, followed by interest rate hikes and then the balance sheet run-off. Present-day, the Fed had to accelerate their tapering efforts and they are likely going to have to increase rates and start QT at the same time. We do not have a crystal ball, but this is highly likely to provide headwinds to the market.

The next part of the market set to turn from a tailwind into a headwind is fiscal policy. After the failure of the Build Back Better plan in Congress, there is no more massive stimulus coming to the rescue. We have already added $6 Trillion in debt to the federal government's balance sheet over the past two years. This was on top of the significant fiscal stimulus we had before the pandemic in the form of the 2017 Tax Cuts and Jobs Act. Now, based on President Biden's State of the Union speech, we might even be on track to cut the fiscal deficit and raise taxes. While this may be good in the long run, a pull back on fiscal stimulus will be a headwind to the market in the near to intermediate-term.

Finally, we have inflation, which after being extremely stable over the past couple of decades, has reached its highest level in 40 years. Energy and commodity prices are spiking around the world. We have the first full-scale invasion of a European country since World War II, further disrupting commodities and supply chains. All of this leaves little room for an accommodative Fed or a spendthrift Congress to step in.

Soh ow do we believe investors should proceed? It starts with favoring active investing over passive investing, as selectivity will be key. Value investing over growth investing as higher inflation weighs on companies dependent on forecasting cash flows far into the future. Lastly, and most importantly, fundamentals over speculation. Without the flood of liquidity from the Fed and fiscal stimulus from the federal government, investors need to rely on research and analysis to find alpha, not by putting it all on double zeros. We've been positioning our clients for this environment for quite some time. Our award-winning process focuses on companies with stock-specific catalysts, and secular macro tailwinds led us to invest in companies that will benefit from higher inflation since the middle of 2020. We are also emphasizing equities that follow our carefully researched themes of overleveraged economies, slowing long-term economic growth, and a shrinking middle class. We embrace the growth possibilities of innovation through new technologies, but we prefer investing in the companies on the periphery of the trend. And lastly, we construct portfolios that we believe prioritize the best risk/reward opportunities while minimizing drawdowns relative to our benchmarks.

We welcome your comments on this piece and would be happy to provide more detail on our thoughtful, research-driven investment process. For further information, please email us at [email protected].

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

March 2022

Certain statements may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein does not represent a recommendation by us to buy or sell any security or securities. Managed Asset Portfolios, our clients and our employees may buy, sell or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change. Past performance is no guarantee of future results.