MAP Views: Third Quarter 2018

Jul 16, 2018Most global markets finished the quarter close to where they began as optimism about strong corporate earnings and a resilient economy offset fears about interest rate hikes, inflation, and tensions between the U.S. and many of our trading partners.

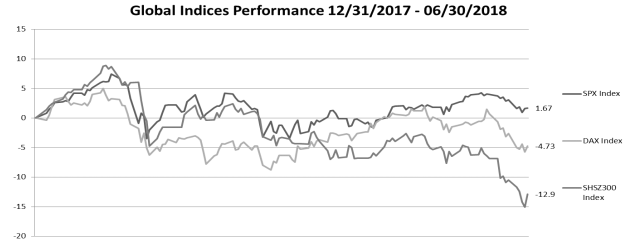

The MSCI ACWI posted a small fractional gain in the second quarter that nearly made up for the loss this index incurred in the first quarter. The S&P 500 gained nearly 3% and including dividends was up nearly 3.5%. Year-to-date, the S&P 500 was up 1.67% (2.64%, including dividends). As the chart below shows, many foreign markets fared worse than the US, especially since trade war talks became heated. Since the start of the year, the Chinese stock market lost nearly 13%, while the German DAX declined nearly 5%.

While talk of tariffs and pending trade wars dominated headlines over the past few months, we view these events as more of a side story relative to Fed rate hikes and fears of escalating inflation. We do not believe there will be long-term ramifications resulting from this war of words (or should we say tweets). In short, we feel that the memories of recent negative rhetoric will quickly fade once there is even a semblance of renegotiation of trade deals.

Since the economic crisis of 2008-2009, investors have been confronted with generally declining interest rates and deflationary concerns. Central banks around the world acted in unison to inject liquidity in the system and drive interest rates lower. The result was historically low-interest rates and even negative rates in some countries. Even today; negative short-term rates are still common in many European countries and Japan. In the United States, however, the Federal Reserve Board has continued its series of rate hikes that it began in December 2015. Since the first hike in 2015, the Fed has bumped rates higher seven times, in quarter-point increments. A declining unemployment rate has afforded the Fed the opportunity to take rates higher.

Also, for the first time in nearly a decade, investors are beginning to talk about inflation. Recall just a few short years ago; deflationary fears gripped investors and central bankers. These fears forced central banks throughout the world to embark upon Quantitative Easing (QE) programs.The Fed, Bank of England, Bank of Japan and the European Central Bank (ECB), all engaged in these QE programs, which involved each of these banks leveraging their respective balance sheets to force interest rates lower. Even today, the ECB and Bank of Japan are continuing with QE programs. We also believe the Fed will take rates up one or two more times this year, but will likely then pause and wait to see whether the rest of the world will follow their direction.

We believe the flatness of the yield curve is quite telling. Note the spread between the 2-year and 10-year Treasury is only about 30 basis points, the narrowest it has been since the economic crisis. If investors thought the economy was going to enjoy a sprint forward, the yield curve would be much steeper. In fact, if the current trajectory continues and the Fed does indeed raise rates a couple of more times this year there is a good chance the yield curve could become inverted by the end of the year. Historically, an inverted yield curve has often indicated an oncoming economic downturn.

We believe that the S&P 500’s relative outperformance compared to the rest of the world was the result of the tax cut passed at the end of last year. This tax cut helped corporations post strong first-quarter earnings and aid in economic growth. Things may not be as rosy going forward. There is growing concern that earnings growth has peaked as inflation begins to creep into companies’ costs. Furthermore, the Federal Reserve’s unilateral actions have resulted in a stronger dollar. The strength in our currency makes it difficult for U.S. companies to grow the international side of their businesses. Finally, on an individual level, rising interest rates will likely dampen the spirits of an overly leveraged consumer. Many of these concerns have started to appear in recent reports that show slowing in the housing and mortgage markets.

One seeming consequence of the negative trade rhetoric was the poor performance in many of the emerging markets. For the quarter, the MSCI Emerging Markets (EM) stock index fell 8.5%,which marked its worst quarterly performance since the third quarter of 2015. For the last several years, we have been significantly underweight EM as we felt their valuation levels were simply too expensive in light of the currency risks we have to assume anytime we buy non-U.S.based stocks. Now that many of these stocks have declined, we are looking to take advantage of the lower prices to increase our exposure to the EM area.

In closing, we sincerely appreciate the opportunity to serve as your investment advisor. It is a responsibility we do not take lightly – or for granted. We continue to work diligently every day, seeking out the best risk-adjusted opportunities for our clients.

Managed Asset Portfolios’ Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton and Zachary Fellows

July 16, 2018

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements.