MAP Views Special Edition - Russia And Ukraine Crisis

Mar 01, 2022Rising Oil Prices Fuel Russian Aggression. What’s Next?

It’s tempting to blame Russia’s invasion of Ukraine on President Putin’s desire to rebuild an empire or at least elevate Russia’s geopolitical influence. We view the aggression as another example of how Russia’s behavior is linked to revenue from oil, regardless of who leads the country. When oil prices are high, actions become bellicose. But when oil prices fall, Russian leaders are compelled to forsake their adventurism and focus on stability and internal affairs.

In this article, we will note how key events in Russian/Soviet history coincide with changes in oil prices. Then we will review key components of today’s Russian economy and consider how Russia’s actions will affect investors.

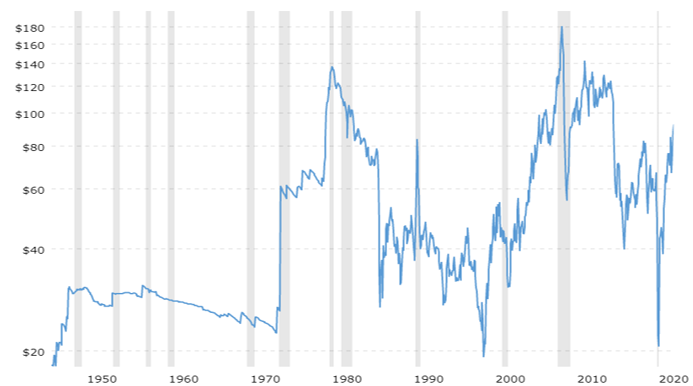

For consistency’s sake, we use inflation-adjusted WTI crude prices as a convenient benchmark for global oil prices.

Afghanistan, The Dissolution Of The USSR And The Annexation Of Crimea

After the 1979 oil price shock stemming from the Iranian revolution and accompanying market panic, petroleum rose to $137. The December 1979 invasion of Afghanistan began when oil rose from the (inflation-adjusted) $60 range to $119.

As Iran resumed production and other OPEC countries stepped in to fill the production gap, prices steadily declined from a high of $137 in May 1980 to fluctuations around the $40 level.

With declining oil prices, the USSR’s appetite for conflict waned. Gorbachev and the Politburo ordered the withdrawal of Russian forces in January 1989, when oil was $39.54 per barrel. Despite Gorbachev’s efforts to introduce economic reforms through perestroika, the government’s limited resources led to the dissolution of the USSR on December 26, 1991.

In February 2014, Ukraine experienced the Maidan Revolution, while the price of oil went to $120. Protests within Crimea against the interim government provided an opportunity for Putin to invade the region under the pretext of ensuring stability. When troops occupied the Parliament building, the Crimean Parliament voted to install a Russian as head of the Republic of Crimea.

The Russian Economy Today

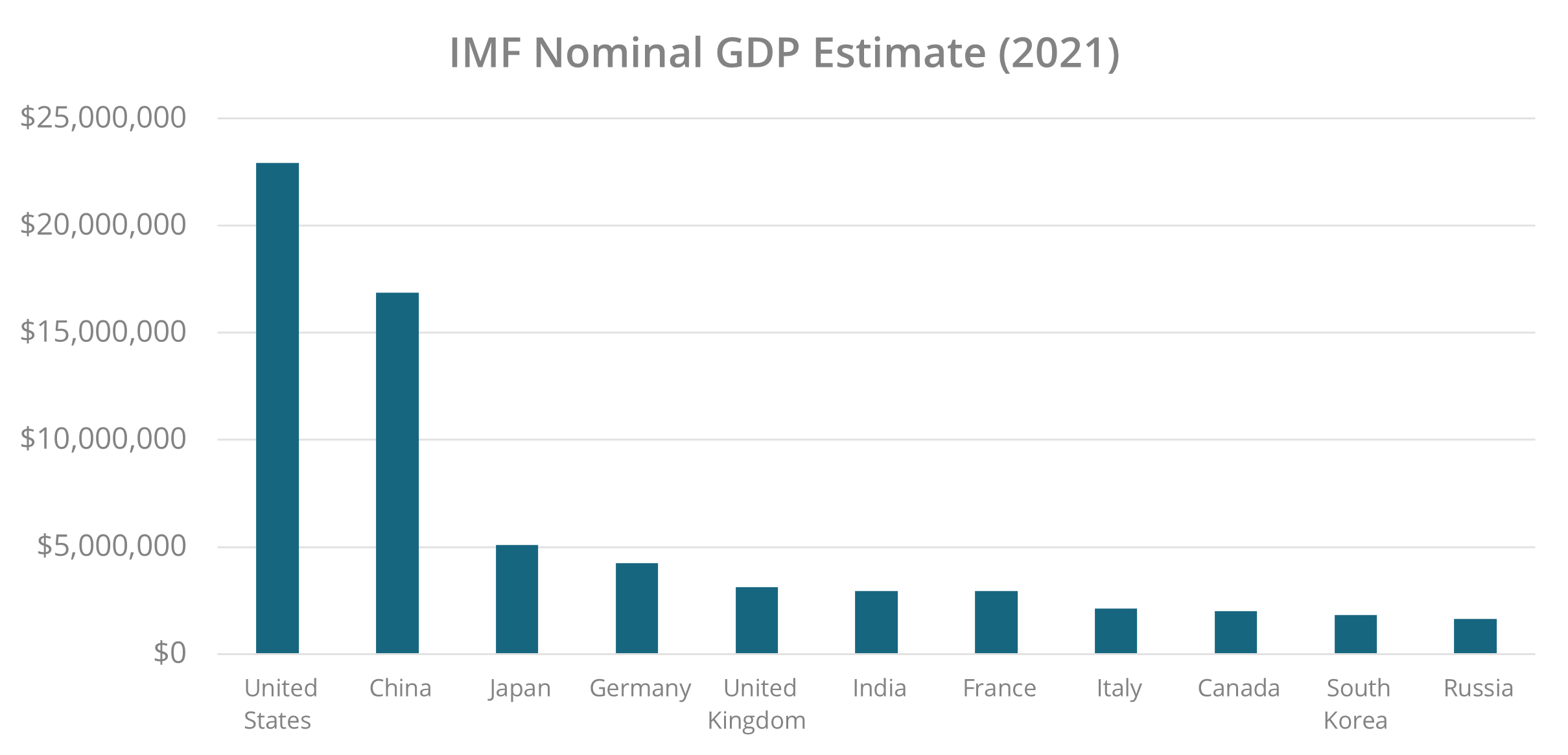

Russia is one of the most perplexing countries when analyzing its standing globally. They have a large, modernized military, are a nuclear power, and until 2014 were a member of the G8. However, their economy puts them in emerging market (E.M.) territory. Like many E.M. economies, they are highly dependent on natural resources, which make up 60% of their GDP. And as we describe in this article, their fortunes are especially tied to oil and gas. They have the world’s largest natural gas reserves and are the largest exporter. They also are the second-largest oil exporter and have the eighth largest oil reserves. In all, oil and gas represent approximately half of the country’s exports and contribute 15% of GDP. They also are a leader in diamond, gold, platinum, silver, and nickel production. Maybe even more critical than precious metals is that Russia is the world’s largest exporter of wheat, accounting for more than 18% of international exports. Despite all of this, Russia’s nominal GDP is only the 11th largest in the world, behind the likes of Japan, Germany, Italy, Canada, and South Korea. It is even smaller than three U.S. states: California, Texas, and New York. On a Purchasing Power Parity (PPP) GDP basis, Russia does stack up better as the sixth-largest economy, with a gross domestic product of $4.47 trillion. Still, no matter its size, Russia has used its military status and strategic natural resources to make itself critical to the global economy, especially those in Europe.

Fortress Economy … Maybe?

Using their critical status in the world economy and the global sanctions levied on Russia upon its 2014 invasion of Crimea encouraged Putin to insulate itself against new sanctions.

Today, its external debt is now only 20% of GDP, and the country has $640 billion in foreign reserves and a substantial war chest. Focusing on agriculture has allowed it to shift from importing grain and other agricultural commodities to being a leading exporter to Europe. These actions have led the country’s economy to be described as “Fortress Russia” for its perceived ability to withstand new sanctions. However, the redirection of government resources to reserves negatively impacted the quality of life for Russia’s citizens.

The Conundrum

As dependent as Russia may be on exporting energy, the West’s ability to levy sanctions will be tested by its energy dependence. Europe may curtail overflights of Russian aircraft and freeze Russian oligarchs’ assets, but Europe relies on Russia for over 30% of its natural gas needs and a quarter of its oil requirements. The post-USSR global trade that NATO leaders expected would lead to Russian democratization has led to an energy standoff.

With the West already facing high energy prices before the invasion of Ukraine, there are few painless options. Though some of the European energy shortages can be offset through shipments of liquified natural gas from other countries, this would only spread the burden of higher prices to more countries and would not offset much of the deficit in Europe. The annexation of Ukraine would create new economic threats. Ukraine is regarded as “the world’s breadbasket. ”It provides 13% of the world’s corn imports and 12% of wheat imports.

We do not expect Russia to halt its aggression against Ukraine, but we don’t foresee a global military conflict either. We find Putin placing Russia’s nuclear forces on “high alert” while keeping Europe-bound pipelines flowing to be intriguing evidence of Russia’s dependence on energy exports.

The West shows no indication of allowing the invasion of Ukraine to go unanswered. After initially announcing a sanctions package widely criticized as weak, Western governments have united in announcing much more robust sanctions. Multiple Russian banks have been removed from SWIFT. The Russian Central Bank has been sanctioned, which according to Goldman Sachs, could make 65% of their FX reserves useless in defending the Russian Ruble. Vladimir Putin and his foreign minister Sergei Lavrov have been personally sanctioned. And countries that have traditionally remained neutral in the sanctions, specifically Switzerland, have frozen Russian assets. However, they still have not sanctioned grain or energy exports, allowing the Russian economy to continue to generate cash flows, blunting some of the impacts of the sanctions. On the other side of things, it could be argued that the sanctions limiting Russia’s ability to access its reserves while allowing them to ship oil and gas still will take that away as a potential geopolitical weapon of Putin. Now we do not try to be military or geopolitical strategists. However, we believe that no matter what, the end result will be absolute devastation for the Russian economy and the likelihood of further global commodity shortages. All of this only further cements our belief that inflation will remain a dominant threat in our global economic outlook.

MAP Is Well-Positioned For An Inflationary Environment

Though the global outlook is concerning, we remain confident that our core values and unique process will help us successfully navigate this pivotal time.

Why are we confident in this uncertain time? For one, we have always constructed our portfolios to mitigate downside volatility. We select companies that benefit from strong secular themes and have idiosyncratic catalysts to help unlock their value. Second is our belief that inflation is likely here to stay for the next couple of years. We are likely not going to be at the levels we are at now, but we also think inflation stabilizes a couple of points higher than the 2% the Federal Reserve is targeting. Historically, value stocks have outperformed growth during inflationary times, acting as a tailwind for our strategies. For example, World Value was the second-best performing asset behind gold during the inflation run of 1973 to 1983.[1] From 1927 to 2020, the average real return of small-cap and large-cap value was the first and third-best performing assets when inflation was above the median.[2] We expect this difference to be even more pronounced as speculative valuations unwind.

Furthermore, this is an excellent time to remind current and prospective clients that MAP avoids investing in countries without the transparency we require to provide us with the confidence necessary to do so. This has specifically been the case in Russia and China, and we will continue to utilize our need for transparency going forward.

West and ready to evaluate the opportunities these markets will offer astute investors and would welcome speaking with you about our award-winning, value-seeking, and risk-averse strategies.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

[1] Data compiled by Goldman Sachs, Datastream, Stoxx, Haver Analytics, St. Louis Federal Reserve

[2] Dimensional Fund Advisors

March 2022

Certain statements may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein does not represent a recommendation by us to buy or sell any security or securities. Managed Asset Portfolios, our clients and our employees may buy, sell or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change. Past performance is no guarantee of future results.