MAP Views Second Quarter 2023

Apr 03, 2023Who's On First?

When the quarter began, all eyes were on the Federal Reserve (the Fed). The question on everyone's mind was how high is the Fed willing to push rates to drive inflation back to their stated two percent target? The Fed had already slowed its cadence from 75 basis points in November to 50 in December and 25 in February. Hotter-than-expected inflation data earlier in the quarter heightened speculation that perhaps the Fed would increase rates again by 50 basis points at the March meeting and likely add on a few more hikes by mid-year.

However, the failures of SVB Financial and Signature Bank and the forced buyout of Credit Suisse by UBS Group AG changed the focus for investors and, ultimately, the Fed, resulting in a 25 basis point increase at the March meeting. In prepared remarks, the Fed also stated it was rather noncommittal regarding its future activity. Furthermore, in an effort to contain these failures, the Fed announced it would make available additional funding to eligible depository institutions to help assure that banks have the ability to meet the needs of all their depositors. In doing so, the Fed has once again started raising the size of its balance sheet to nearly $9 trillion. These actions have caused a reset in the markets and our thinking, with the belief that they will now likely hit the "pause button" at the May meeting and wait and see how recent financial news will impact the economy and inflation.

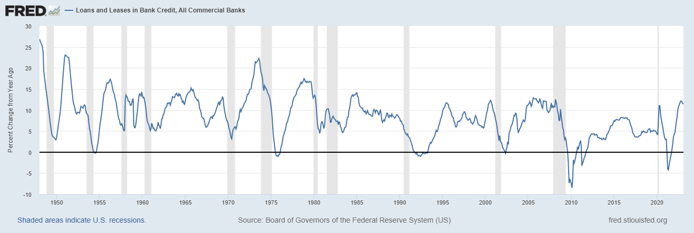

Academic debates continue regarding the time lag between changes in monetary policy and inflation. And while some argue it is as short as six months, others claim it can be up to two years. Either way, the Fed is always at the disadvantage of driving while looking in the rearview mirror. We believe the recent difficulty in the banking sector will likely lead to tighter regulation and further credit tightening. Typically, as depicted in the chart below, the economy needs credit expansion to grow, so a pullback in lending could weigh on the economy. That said, we continue to position the portfolios for an economic environment that is challenged to find growth and where inflation rates decline from current levels but remain above the Fed's two percent target.

We believe the combination of elevated inflation and banking uncertainty leaves the Fed caught between a rock and a hard place. By pausing rate hikes, they risk falling further behind in their battle to drive inflation lower; and by continuing to raise interest rates, they risk worsening the environment for banks. From a historical perspective, since 1977, the Federal Reserve has operated under a mandate from Congress to promote maximum employment and stable prices. We would add a third mandate (though unwritten) deemed 'market stability.' 1998 is a perfect example of this mandate in action. Under the leadership of then-Chair Alan Greenspan, the Fed rescued the markets after a large hedge fund, Long-Term Capital Management faced failure, threatening the banking sector and the broader markets.

What's On Second?

As mentioned above, we now believe the Fed will likely hit the pause button at its next meeting and take a wait-and-see approach before taking further action. This is a bit earlier than we initially thought, but it is unlikely that they would want to exacerbate the banking predicament. Additionally, we believe banks, especially the regionals, will likely reduce their lending, dampening the economy further. This can be particularly negative to the vitality of the U.S. economy, which relies on smaller regional banks to generate a significant portion of its Commercial & Industrial loans and commercial real estate loans.

Even before recent bank news, economists and our Investment Team were forecasting anemic growth for 2023 due to the Fed's tightening. On the surface, one would think that a weakening economy would lessen inflationary pressures. And while that may help, as we have outlined in previous pieces, we believe three structural issues should support inflation above the Fed's two percent target for the foreseeable future.

- Wages. Much of the inflationary pressures over the past few years have centered around wages. Unlike commodities, which tend to go up and down, wages do not. A shrinking pool of qualified workers will likely be supportive of elevated wages.

- 'Greener' Environment. We are clearly on a path toward a greener environment. We believe this will increase energy costs. Since energy touches nearly every aspect of the economy, higher energy costs should keep inflation above targets.

- Re-globalization. For years, Americans have been able to buy many goods made in other countries cheaply. With many companies reconsidering their reliance on China, manufacturing may move to countries with higher labor costs. For example, new semiconductor plants are planned for Arizona, Oregon, Ohio, and upstate New York. For reference, manufacturing costs in the U.S. are about three times higher than in Taiwan. With that said, however, we don't believe it is possible to rid the supply chain of China altogether. This is why we now use the phrase re-globalization instead of deglobalization to describe this phenomenon.

Despite the underpinnings for elevated inflation, interest rates have been declining. Two-year Treasury yields peaked north of 5% in February and ended the quarter around 4.125%. Ten-year Treasury yields also fell from their February highs, but not as much, making the yield curve less inverted. Lower rates are music to the ears of bankers that have seen their bond portfolios decimated by rising interest rates.

In MAP Views, we have often opined that we did not believe the risk/reward returns were favorable for holders of intermediate to long-term dated fixed-income instruments. Accordingly, we have been keeping our weighted average maturities short. During 2020 and 2021, the performance of our fixed income portfolios was impacted slightly, as we missed out on some capital appreciation. (Keep in mind that longer-dated bonds appreciate more when interest rates are falling; conversely, they depreciate more when rates are rising). In 2022 and year-to-date, however, we have fared quite well relative to our peers. At the end of every MAP Views publication, we state that we strive to deliver the best "risk-adjusted" returns. This is a prime example of that phrase being placed into action. Since the beginning of the Great Financial Crisis (GFC) that began in 2008, it is worth noting that we have gradually extended our maturities as interest rates have moved higher. We have also increased the portfolio's credit quality, heading into what is likely to be a period of economic softness.

Where Is Third?

Recent activity in the banking sector has created what we believe to be an opportunity with Certificates of Deposits (CDs). Many banks have been forced to "pay up" for fund flows by offering generous yields on their brokered CDs. During the later part of March, we were able to invest proceeds from maturing bonds into Federally Insured CDs (subject to FDIC limitations) offering yields comparable to many investment-grade corporate bonds with similar maturities - and, in some cases, 15 – 20 basis points below high yield issues. This is yet another example of how we, as portfolio managers, strive to generate the best risk-adjusted returns. In fact, it is worth noting that we have avoided high-yield corporate bonds altogether. And while the yield curve remains inverted, we continue to shun longer-dated bonds. We would also note that the ten-year bond, with a current yield to maturity of approximately 3.5%, is not attractive given our inflation expectations of 3% – 5% for the foreseeable future.

Regarding equities, we are sorting through bank/financial stocks, looking for that 'diamond in the coal mine.' We are, however, not in a rush to jump into the space as we believe more problems may be lurking under the surface. Additionally, an inverted yield curve will likely weigh on banks' net interest margin and pressure earnings. Lastly, as previously indicated, increased regulation will likely result in more significant capital requirements, further pressuring profits.

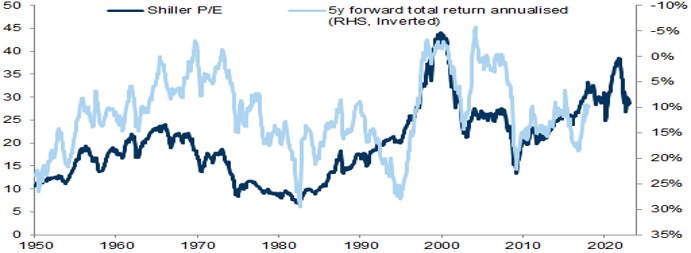

As for the broader markets, we are cautiously optimistic. Granted, an economic downturn may very well be in the cards for later this year, and inflation is still not under control. But valuations have come in quite a bit over the past year and a half. To examine the attractiveness of valuations, we look to the Cyclically Adjusted Price-to-Earnings (CAPE) ratio, which measures real earnings per share (EPS) over a rolling 10-year period to smooth out fluctuations in corporate profits that occur over different periods of a business cycle. As the chart below illustrates, the current CAPE multiple is off more than 20% from its 2021 highs and forecasts annual 5-year stock market returns to be in the 8% – 10% range, near historic levels.

As always, we continue to work diligently to deliver the best risk-adjusted returns for our clients. We truly appreciate the confidence you place in us. It is a responsibility we do not take for granted or lightly. Please do not hesitate to contact your MAP representative with any questions.

Happy Spring, everyone. Stay well!

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

April 2023

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent are commendation by us to buy or sell this security or any other financial instrument associated with it. Managed Asset Portfolios, our clients and our employees may buy, sell or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change.