MAP Views Second Quarter 2022

Apr 04, 2022Investors faced several daunting challenges during the first quarter. The war in Ukraine stole the spotlight during the second half of the quarter, but even before that tragedy began to unfold, the investment landscape was changing dramatically for investors. Inflation went from being “transitory,” in the words of the Federal Reserve (Fed), to four-decade highs. The Fed went from buying $120 billion worth of bonds monthly to discussing when to begin selling some of those bonds. Interest rates moved from record lows to three-year highs, marking the worst quarterly performance for bonds in about four decades. Stocks with sizzling storylines and lofty valuations went from being among the best performers to among the worst.

Welcome to the “new norm.” Except for a few quarters in 2017 and 2018, investors have enjoyed smooth sailing, compliments of a highly accommodative Fed. In short, we believe the investment landscape has changed dramatically. The unprecedented amount of fiscal and monetary stimulus stemming from the government’s efforts to jump-start the ailing economy triggered by the COVID-19 shutdowns caused many to blur the lines between investing and speculation. As a result of the government’s actions, interest rates fell to their lowest levels in recorded history. We believe inflation is likely to remain well above the Fed’s target rate for years to come stemming from a confluence of higher wages (which, unlike commodity prices, only tend to go higher) and rising energy costs. Inflation is starting to impact global economies. While headline fourth-quarter GDP came in at a stout 6.9%, if you subtract one-time inventory adjustments stemming from lingering supply chain issues caused by the pandemic-induced shutdowns, GDP was only approximately 2%. Consensus estimates call for further slowdowns in economic activity during the first quarter, with the Atlanta Fed currently projecting Q1 growth to be just 1.3%.

It is quite unprecedented for the Fed to begin a tightening cycle (raised rates in March by ¼ point – the first in a series of rate hikes to curb inflationary pressures) when GDP growth is weakening. While their recent actions will likely be considered a misstep when we look back at the history books, we believe the Fed will be hard-pressed to fulfill both of its mandates of full employment and stable prices at the same time. In fact, we believe tightening should have started last year if they wished to accomplish this task. Disruptions from COVID gave the Fed an excuse to delay tightening, and now the Russian invasion of Ukraine gives them yet another reason on the inflation front. Some politicians in Washington are already calling this Putin’s inflation, but, as we have been reporting, inflation was well underway even before the first shots were fired.

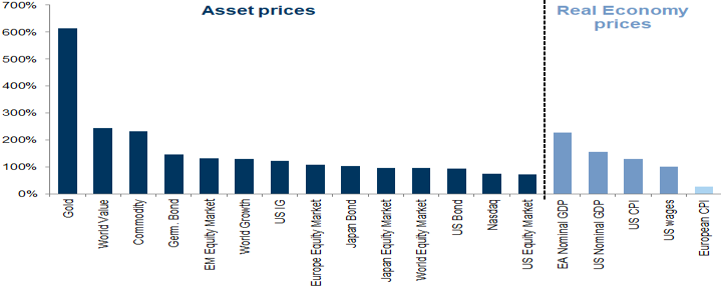

Elevated inflation is music to the ears of value investors. As the graph above illustrates, value stocks did quite well during the last decade of peak inflation (1973 – 1983). Of course, while past performance is not a guarantee of future results, intuitively, it makes sense for value to outperform during periods of inflation. Investors buy the underlying company’s future earnings and dividends when purchasing a stock. If investors are worried about inflation eroding their future buying power, then they will compensate for that by paying less for these earnings. Additionally, they will place a premium on companies generating cash flow now versus those whose valuation is dependent on becoming cash flow positive five years down the road. The inverse is true when prices are stable. During the last period of peak inflation, the price/earnings (P/E) multiple for the S&P 500 was 10. Elevated P/E multiples of 20 or more are generally achieved during periods of modest price increases.

Looking forward, the pace at which the Fed tightens will play a significant factor in future stock market performance. As the chart below depicts, stocks tend to perform the best when the Fed is not tightening, but they still show good performance when the Fed is only modestly tightening. It is only when the Fed is aggressive with tightening that stocks struggle. Many economists are calling for a series of seven hikes this year. We doubt if the economy has the underlying strength to manage that many hikes without heading into a recession. The spread between the two-year and ten-year Treasury bonds has gone from about two hundred basis points (2 percent) to nearly flat today. Should that curve invert (and stay inverted for a meaningful period), there is a very high probability of the economy entering a recession. In fact, over the last five decades, 20 months, on average, have elapsed between the initial yield curve inversion and the beginning of a recession in the United States.[1]

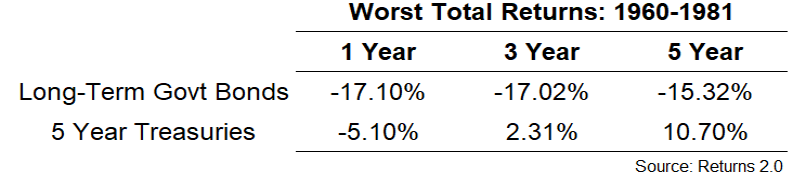

Rising inflation and interest rates have taken a toll on the bond market, with bonds posting their worst quarterly performance in over four decades. We believe the first quarter of 2022 may have marked a violent end to a multi-decade bull market for bonds. Historically, interest rates tend to move in multi-year, even multi-decade, cycles. The last bear market for bonds occurred from 1946 to 1981, and before that, there was a bear market from 1899 to 1920. We would not rule out the possibility that we are entering the start of another bear market for bonds. Generally, bear markets follow periods of peak euphoria. We certainly experienced that in the bond market, with over $18 trillion worth of bonds trading at levels that provided negative rates of return for investors last year. Within a few short months, that number has plunged to just $2 trillion.

We question what took so long. Clients are aware that we have been keeping our bond maturities short for quite some time. Our stance was that owning long-dated bonds was equivalent to picking up pennies in front of a freight train. While our short-term maturities served as a headwind for returns when rates were falling, they certainly aided our relative performance this past quarter. The last time inflation levels were at double digits, long-term Treasuries were at 13 percent, and money market accounts yielded close to 20 percent. Today, long-term Treasuries yield under three percent, while short-term paper pays a fraction of a percent. All while double-digit inflation numbers are likely right around the corner. We believe current bond yields, even after the selloff (recall that bond prices move inversely to interest rates), do not adequately reflect current or future inflation levels. Accordingly, we believe the bond market will face strong headwinds over the ensuing years. Our current weighted average maturity (WAM) for the bond holdings in our Balanced strategies is just over two years. Our WAM is about one-year if we exclude the series of Treasury Inflation-Protected Securities (TIPS) that we hold for inflationary protection. We believe this is prudent, as it provides downside protection should rates continue to move higher and allows us to reinvest maturing bonds into higher-yielding ones.

As we move into late spring/early summer, primaries for the mid-term elections will enter the spotlight. The possibilities of more stimulus and higher taxes would have significant ramifications for the economy and investors. This upcoming election may be one of the most important in recent memory. We will publish a thought piece on the subject later this quarter for more insights on the upcoming election and its impacts on the economy and financial markets.

We continue to work diligently to deliver the best risk-adjusted returns to our clients. Thank you for allowing us to serve as your investment adviser. It is a responsibility we do not take lightly – or for granted. We are wishing everyone a safe, healthy, and enjoyable Spring!

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent are commendation by us to buy or sell this security or any other financial instrument associated with it. Managed Asset Portfolios, our clients and our employees may buy, sell or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change.

April 2022

[1] https://www.statista.com/statistics/1087216/time-gap-between-yield-curve-inversion-and-recession/