MAP Views: Second Quarter 2020

Apr 06, 2020Stocks began 2020 on an up note, with most major averages (both domestic and global)hitting record highs around mid-February. However, optimism accompanying these record highs quickly dissipated, as government actions designed to slow the spread of the COVID-19 virus took their toll on the worldwide economy. Losses from the S&P 500’s February record high reached 34% before a two trillion dollar plus government stimulus program ignited a historic three-day rally of 18%, trimming losses for the quarter. At quarter-end, the S&P 500 was off 20%,and the MSCI ACWI lost 21%. This performance marked the worst quarter for theS&P 500 since the financial crisis of 2008 and the worst first quarter in 134 years.

We are hopeful there will be a reprieve from the virus in the coming months but will be on the lookout for a resurgence in the fall (along with the traditional cold and flu season). It appears that a vaccine may be widely available in early 2021, which should hopefully put this virus to rest once and for all. Until a viable treatment or vaccine becomes commercially available, we suspect volatility will remain elevated.

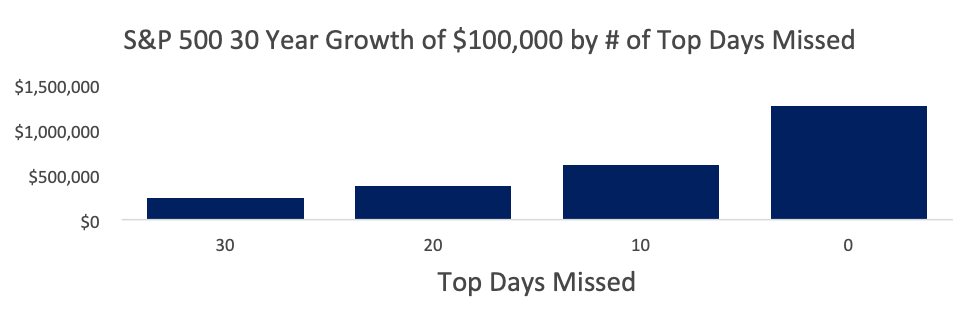

With that said, quite often, we are asked, “Shouldn’t we just go to cash?” We believe it is foolish to try to time the market, as you need to get out in time as well as back in. As the chart below illustrates, missing just a handful of significant up days in the market can have a very detrimental impact on long-term performance.

Missing just the best 30 days out of over 7,500 trading days, translated into an annualized return of less than 3%, versus nearly 9% for those that stayed fully invested. Note this referenced 20-year period includes the bursting of the dot-com bubble, the tragedies of 9/11 and the financial crisis of 2008. Instead of attempting to time the market, we think it is prudent for investors to think about positioning their portfolios for 2021 and beyond.

We believe there will be long-lasting economic and business ramifications that will exist long after the pandemic is resolved. Technology and select pockets of healthcare should be long-term beneficiaries, while travel-related industries, energy and commercial real estate may be permanently impaired. Microsoft recently announced that it is cancelling all of its major in-person events through June2021, while Amazon faced worker protests in New York and Detroit at select Whole Foods stores. These disruptions may encourage companies to accelerate the adoption of technology. Robots for restaurants can now be leased for about$2,000 per month, which equates to $3 - $4 per hour depending on hours of operation.We believe these developments strongly favor investing in technology stocks.

Additionally, we believe healthcare and pharmaceutical companies will benefit from the pandemic over the long haul. Any lingering political backlash aimed at these companies over the pricing of their medicines will dissipate as Washington sees the benefits of having a robust pharmaceutical industry with powerful research and development capabilities.

On the losing side, we suspect that it will be a long-time before cruise ships will be sailing or planes flying at full capacity. Business travel will likely be permanently impaired, as conference calls, video conferencing and webinars become the new norm. Companies are now finding out firsthand that working remotely works. It will be interesting to see what happens when leases start to mature. We suspect many tenants will be looking to lease less square footage, which will negatively impact commercial real estate and the REITs that invest in this asset class.

As government actions to combat COVID-19 have ratcheted up, interest rates have been driven down to record low levels. Longer-term, we have a difficult time reconciling these low rates against increased borrowings across all categories:sovereign, municipal, corporate, and consumer. Furthermore, as mentioned previously, the recent $2 trillion US economic stimulus plan is likely not to be the U.S.’s only stimuli given the extended length of state-mandated shelter in place orders. Eventually, lenders will require a respectable rate of return on their investment. Lending money to the U.S. Treasury for 30-years at 1.25%does not seem like a reasonable rate of return.

We furthermore believe that the events surrounding the COVID-19 crisis will force many companies to question how their current supply chains are structured. These questions may result in more products being made in the U.S. or other Western countries and less reliance on China. Longer-term, this may be inflationary, which would not bode well for holders of longer-dated bonds. As an example, the duration of a 30-year U.S. Treasury bond is about 22. Meaning, if interest rates moved up one percentage point, the value of the bond would decline by about 22 percent.

These are no doubt challenging times. But, so too were 2008, 2001, 1987, etc. We feel more secure during this decline as it seems that a resolution is in sight. In 2008, investors never knew which bank or insurance company would fail next. Today, the end game is a treatment or a vaccine to prevent COVID-19. While a vaccine can’t come soon enough, it appears that early 2021 is likely. We have positioned our clients’ portfolios to weather near-term headwinds that will likely take place as a result of this global pandemic and to take advantage of the tailwinds we envision once conditions improve.

Being active managers, we have revised our clients’ portfolios to reflect the changing landscape. We exited names that had the most significant exposure to the changed consumer behavior while taking advantage of lower valuations to buy some quality stocks that were not available a mere two months ago. Please contact your MAP representative with any questions or concerns.

Stay safe and be well.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, Zack Fellows

April 6, 2020

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. Past performance is no guarantee of future results.