MAP Views Fourth Quarter 2022

Oct 04, 2022The Inflation Monster Rears Its Ugly Head

Stubbornly high inflation has forced the Federal Reserve (the Fed) to become aggressive on the interest rate front, raising rates five times in 2022. These higher interest rates created a hostile environment for most asset classes. Stocks, bonds, most commodities, and virtually every currency (except for the U.S. dollar) - even real estate – have come under pressure, leaving few safe havens for investors. Stocks fell for the third consecutive quarter in 2022, the longest losing streak for stocks since the Great Financial Crisis in 2008. Bonds have traditionally served as a safe haven during periods of volatility; however, even they are on pace for their worst yearly performance since the end of World War II. Ironically, commodity prices that were soaring last year, when the Fed was claiming inflation was merely transitory, have tumbled as of late now that the Fed has become more concerned about inflation.

Evidence is mounting that the Fed’s aggressive stance is beginning to take a toll on the broader economy. Several retailers have announced significantly weaker financial results, signaling that the average American consumer is starting to feel pain. Broad-based economic bellwethers like FedEx (FDX) have indicated that they sense a pending recession, and even went so far as to warn that labor shortages could lead to stagflation in the U.S. Strangely, employment data remains fairly robust as employers are reluctant to cut staffing in an environment where the supply of qualified employees remains somewhat scarce. It is baffling to see companies adding jobs in an environment where we have experienced back-to-back quarters of negative GDP. This signals plunging productivity, something no one seems to want to address. Maybe this explains why many employers are trying to get staff back into the office, despite pushback from some employees.

Inflation Wasn’t So Transitory After All

As we mentioned previously, a year and a half ago, the Fed called inflation “transitory.” You may also remember that we disagreed with them then, and we highly doubt that a “healthy” level of two percent inflation will return within the Fed’s revised timeframe of 2025 (a revision to their June estimate of 2024). At the end of the day, we believe the Fed will be forced to accept an inflation level above their two percent target. We would not be surprised to see long-term inflation settle in at the three to five percent range. Some economists and media personalities have attempted to draw similarities between Paul Volcker and Jay Powell given that the last time the U.S. saw excessive inflation was during Mr. Volcker’s tenure as Fed Chairman. Volcker was the chairman of the Federal Reserve from 1979 to 1987 and is widely credited with ending the double-digit inflationary environment he inherited when accepting the position and paving the way for a nearly four-decade run of inflation that more or less hugged the Fed’s desired two percent target.

The environment facing Chairman Powell and the current Fed is totally different than the environment faced by Paul Volcker. The critical difference is the amount of debt in the system. U.S. federal debt stood at approximately $1 trillion in the late seventies, and early eighties. Today’s debt exceeds $30 trillion. Since the start of the COVID -19 pandemic, federal borrowing has exceeded $7 trillion. For perspective, it took the U.S. government 215 years to accumulate its first $7 trillion in debt. For that matter, the U.S. (and most of the world) have become financial junkies, and their drug of choice is cheap and easy money.

Since the late 80s, U.S. GDP grew from just under $3 trillion to about $23 trillion. To illustrate further, let’s assume the weighted average borrowing cost for the U.S. government increases to five percent. Federal debt exceeding $30 trillion would put annual interest costs at about $1.5 trillion. To put this in context, the government currently spends about $750 billion on national defense and annual tax collections total about $4 trillion, meaning that interest costs and defense would consume well over one-half of total revenues.

Asset Allocation In The Face Of Higher Interest Rates

Market declines are always challenging. Years of experience, supported by many academic studies, have shown that through complete market cycles, investing in stocks has been one of the best means of accumulating wealth and that market timing is generally not successful. We believe the Fed will ease up on their tightening sometime during the first half of next year. Considering that the market is usually forward-looking, we would not be surprised to see the market begin to stabilize in the not-too-distant future.

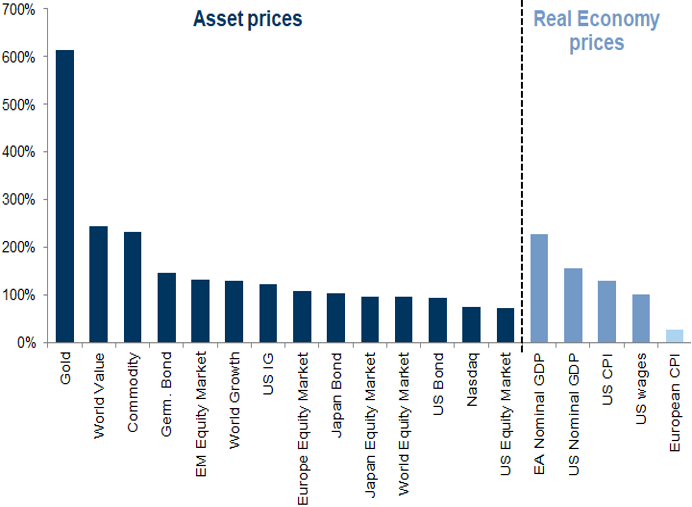

We believe a longer-term inflation clip of three to five percent will pose challenges for longer-dated bonds at current levels. It will also likely cause investors to re-evaluate what valuation levels they are willing to pay for stocks. The chart below shows that during the last decade of peak inflation, the World Value category was the second-best performing asset class, trailing only gold and a step ahead of commodities. Given our belief that elevated inflation will be with us for an extended period, we believe value stocks should outperform their expensive growth counterparts.

Source: Goldman Sachs, DataStream, Haver Analytics, St. Louis Federal Reserve

As such, in addition to doing selective tax-loss harvesting last quarter, we made several portfolio changes. We trimmed some positions while adding to others, focusing on our highest conviction ideas. We continue to view a large amount of debt in the system as hindering economic growth and will do so for the foreseeable future. Accordingly, we have a sizeable weighting towards consumer staples and have increased our exposure to health care. We also increased our weighting to fixed income products slightly in our balanced portfolios to take advantage of higher yields, while keeping maturities relatively short.

Thank you for allowing us to serve as your investment manager. It is a responsibility we do not take lightly, as we work diligently to deliver superior risk-adjusted returns over complete market cycles. Please get in touch with your MAP representative with any questions or concerns.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent are commendation by us to buy or sell this security or any other financial instrument associated with it. Managed Asset Portfolios, our clients and our employees may buy, sell or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change.

October 2022