MAP Views First Quarter 2026

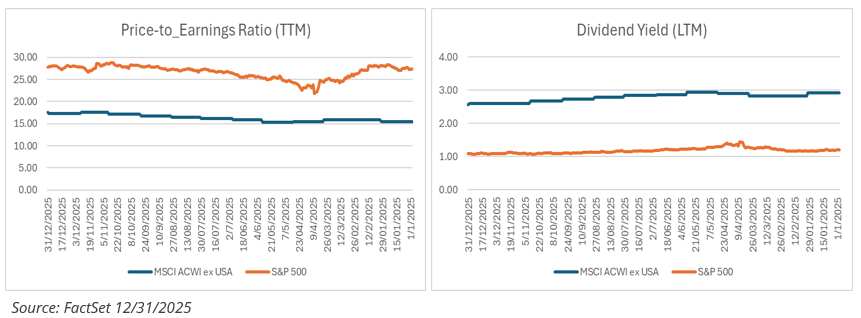

Jan 05, 2026Stocks marched higher for the third consecutive year, as investors shrugged off persistent inflation concerns, a host of geopolitical risks, and lofty valuations. Unlike 2023 and 2024, U.S. stocks trailed their foreign peers. The S&P 500 gained 16.39% in 2025 compared to 22.87% for the MSCI AC World Index (ACWI). Stocks entered the year with lofty valuations, and the S&P 500 exited the year with even higher valuations, selling at a near-record 27.88 times earnings on a trailing 12-month basis. On a forward basis, the valuation of the Magnificent 7 (29.0 times) finished the year 1.40 times larger than that of the S&P 493 (20.2 times). We struggle to see where U.S. valuations expand much from current levels, though we do believe market breadth should continue to improve. To the contrary, the MSCI AC World, selling at a much more modest 18.9 times forward earnings, has further room to expand, in our opinion. There is also a noticeable difference between dividend yields, with the yield of the S&P 500 at 1.1% and the MSCI at a more favorable 1.7%. These divergences are even more pronounced when looking at the MSCI ACWI ex USA, as seen below. Accordingly, we continue to be overweight foreign names in our Global Equity portfolios. Even our U.S. Multi-Cap Value portfolios lean towards more multinational names than U.S. only names.

As we look forward to 2026, we believe the economy will continue to advance and believe there is a stronger likelihood of an economic acceleration than a recession. Growing debt levels will force the administration to let the economy run “hot,” even if it means inflation will not decrease towards the Federal Reserve’s (the Fed’s) 2% target. Treasury Secretary Scott Bessent recently commented that the Fed may revisit its 2% target, calling the notion of decimal-point certainty “absurd.” Instead, he suggested that the future inflation-targeting ranges could be 1.5% - 2.5% or 1% - 3%. At their December meeting, the Fed forecasted one interest rate cut in 2026 and one in 2027. Current Fed Chair Jay Powell’s term ends in May. Donald Trump’s replacement selection for Fed Chair will likely be made public within the next few weeks. The prediction markets are calling for either Keven Hassett or Kevin Warsh to succeed Powell. Either one will likely be more dovish and will likely be bigger advocates for interest rate cuts. As such, we doubt that the Fed will stop at one, and believe multiple cuts are in the cards for this year. Changing the target for inflation from a set 2% to a wider band will also make it easier to cut rates, with inflation remaining elevated.

We would not be surprised to see the administration attempt to push economic growth into the mid-term elections. Trump has publicly suggested that Americans could receive “tariff dividends,” but roadblocks remain, including the upcoming U.S. Supreme Court case that will determine the legality of Trump's sweeping tariffs. Treasury Secretary Bessent threw out an income benchmark of $100,000 to be eligible for the dividends. High-income consumers are among the first to increase their discretionary spending when economic conditions improve, which drives consumption. For reference, income thresholds for COVID relief payments were $75,000 for single/$150,000 for joint filers, with the third round of payments allowing partial relief for $80,000 single/$160,000 joint.

While the devil remains in the details, it is conceivable such actions would give a boost to the economy, but unfortunately may likely contribute to inflationary pressures. A combination of a stronger economy, coupled with lower interest rates and higher inflation would likely put further downward pressure on the U.S. dollar. The dollar (as measured by the DXY) finished 2025 down 9.4% relative to a basket of major currencies and was the weakest of 17 major currencies. While not insignificant, as we have indicated in previous issues of MAP Views, we have seen worse declines. From 2000 to 2007, the greenback fell 40%, and the five years following the signing of the Plaza Accord (1985 – 1990), the dollar fell 50%. It is worth noting that during both of those extended periods of decline for the dollar, foreign stocks outperformed U.S. stocks by a 2-to-1 margin.

Historic rallies in 2025 for gold, silver, copper, and platinum could be a harbinger of what is yet to come. Given the stoutness of the recent rallies in these metals, a pullback would not be surprising, but we believe we are in the early innings of a multiple year decline for the U.S. dollar, which would benefit many of the foreign markets as well as commodities such as metals and agriculture.

The Fed will likely do their part to lower interest rates on the short-end of the curve, but that does little to move the longer-end of the curve. Since the current interest rate cutting cycle began in the fall of 2024, the Fed has cut interest rates by a cumulative 175 basis points, while 30-year mortgage rates are basically flat. We believe further cuts by the Fed will result in a steeping of the yield curve, helping the government keep interest expenses somewhat under control, but doing little to help consumers who are trying to finance housing purchases. Keep in mind that 84% of all government borrowings in 2025 were for one year or less, and less than 2% were for 20 years or more. We continue to see more risk than reward on the intermediate to long-end of the interest rate curve. We have positioned portfolios containing fixed income securities accordingly, and our average weighted maturity is approximately 1.5 years.

With that said, do not underestimate the importance of fiscal stimulus. Governments both domestically and abroad are likely to continue spending and borrowing. Overtime, this will likely lead to inflation remaining elevated and eventually a shift to higher interest rates.

We are grateful for the trust you place in us and for the patience that allows our investment approach to work as intended. Regardless of the economic environment, we remain focused on what matters most: preserving and growing capital over time. We enter the New Year with confidence in our process, optimism about the opportunity set before us, and an unwavering commitment to disciplined global value investing as we strive to deliver the best risk adjusted returns possible.

Wishing everyone a happy, healthy, peaceful, and prosperous New Year!

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, Zachary Fellows, John Dalton, and Nicolas Vilotti

January 2026

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent are commendation by us to buy or sell this security or any other financial instrument associated with it. Managed Asset Portfolios, our clients and our employees may buy, sell or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change.