Managed Asset Portfolios: A 25-Year Foundation

May 21, 2025The last 25 years in the markets have been nothing short of historic. Expansions and contractions, global conflicts, and rapid changes in technology and legislation have reshaped the financial landscape. From the dot-com bubble, the September 11 attacks, the Great Financial Crisis (GFC), and the COVID-19 pandemic, to the rise of Artificial Intelligence (AI) and everything in between, investors experienced no dearth of market-moving events. While the investment landscape has changed since our founding in 2000, MAP’s investment strategy has remained consistent. As a global value manager, our Investment Team, utilizing a multi-faceted valuation process is focused on finding opportunities in securities that meet stated market capitalization requirements in U.S., international and emerging markets. More importantly, the team’s strategy is designed to protect capital during drawdowns, which has served as a foundation for historically strong risk-adjusted returns over time.

As we have opined in previous Thought Pieces, 2023 and 2024 were years marked by a risk-on investment landscape fueled by valuation expansion, American Exceptionalism, and the popularity of the Magnificent 7, driven by the advent of AI. We also cautioned that valuations, particularly in the U.S. were stretched in an environment where interest rates were likely not going lower and inflation would remain above the Federal Reserve’s (the Fed’s) 2% target. Fast forward to 2025, and our concerns regarding valuation came to fruition as the new U.S. administration took office and began enacting its economic agenda. The result was the eighth worst start to a year for the S&P 500 Index in history. Investors took notice, and global stocks became the beneficiary as valuations were more attractive elsewhere relative to the U.S. markets.

If you are a current client, you already know how your account fared during this period. If you are one of our long-term clients, while past performance is no guarantee of future results, you know that this is not the first time our strategies have outperformed during periods of uncertainty. However, as a prospect, this concept may be new to you. Our equity strategies have various inception dates, but over the long run, they have all experienced better relative performance during periods when the market is down, flat, or modestly higher. That does not mean our strategies do not go up when the market is in risk-on mode; but it does mean they may not increase as much as the broader markets, given how our portfolios are structured.

Years ago, we used to liken our strategies to a baseball game. With the Detroit Tigers faring so well this season, now may be a suitable time to revisit that analogy. Baseball is a long game, and a team's success is measured over the entire season, not just individual at-bats. While home runs are exciting, building a strong portfolio often involves a series of smaller, consistent returns (singles or doubles) that accumulate over time. However, we do not have to swing at every pitch, or even every strike, because no strikes are called. We carefully and systematically evaluate long-term risk versus reward. Defense is just as, if not more important, than offense. In addition, a legacy franchise does not win the pennant every year, it builds that legacy over a lifetime of seasons.

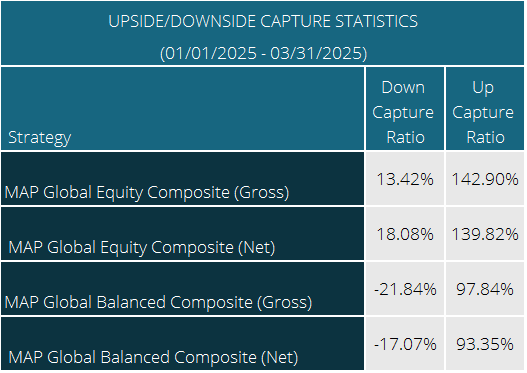

Every baseball manager does not just rely on the score at the end of the game or the record at the end of a season to measure how well the team performed. They look at statistics and evaluate them over various periods of time, much like investment managers do. One performance measure used by investment managers is the downside capture ratio, a measure of how much of a benchmark’s negative returns are captured by a composite or mutual fund. The lower the ratio, the better the downside risk protection. During the first quarter of 2025, based on monthly return data, MAP’s flagship Global Equity composite had a downside capture ratio of less than 20% and MAP’s flagship Global Balanced composite experienced a negative downside capture ratio – meaning the strategy generated positive returns during periods when the benchmark declined. While one quarter is only a small period of time, and we caution these results should not be projected forward, the first quarter of 2025 exemplifies how our portfolios have historically protected capital.

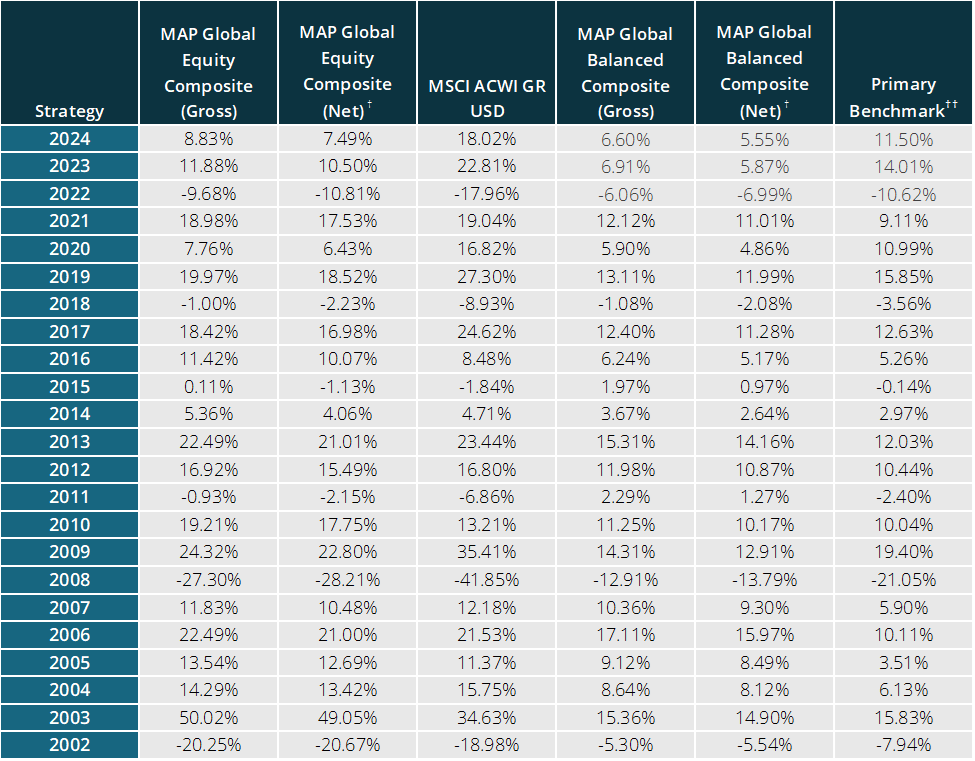

From a long-term perspective, MAP is celebrating its 25th year as an investment manager. During this time, our flagship Global and Balanced composites have experienced minimal significant annual declines, the most relevant of which was during the GFC, at which time each outperformed their respective primary benchmarks by a substantial margin. Once again, we believe this provides evidence that our composites are constructed to produce lower volatility than the stated benchmark and to protect capital during drawdowns. Furthermore, the composites are then poised to deliver strong risk-adjusted returns during a full market cycle as our composites’ starting capital is greater than the stated benchmark once the recovery begins, given that our composites capture less of the downside due to their lower downside capture ratios.

From a long-term perspective, MAP is celebrating its 25th year as an investment manager. During this time, our flagship Global and Balanced composites have experienced minimal significant annual declines, the most relevant of which was during the GFC, at which time each outperformed their respective primary benchmarks by a substantial margin. Once again, we believe this provides evidence that our composites are constructed to produce lower volatility than the stated benchmark and to protect capital during drawdowns. Furthermore, the composites are then poised to deliver strong risk-adjusted returns during a full market cycle as our composites’ starting capital is greater than the stated benchmark once the recovery begins, given that our composites capture less of the downside due to their lower downside capture ratios.

A key component of our investment process is the overlay of structural thematic filters. These are long-term views developed by the Investment Team based on global economic data. They are tantamount to the portfolio construction process as they drive the sectors in which we invest, as well as the weightings of those sectors. Over the last 25 years, the average growth rate of U.S. GDP has been 2.5%. Over the last 10 years, that number has been below 2%. The Investment Team believes that tepid economic growth will continue. Therefore, equity composites remain overweight sectors that do not rely on strong economic growth – sectors such as Consumer Staples, Health Care, and Utilities. Despite our growth expectations, the Team also believes that inflation will remain above the Fed’s 2% target driven by U.S. economic policy and that Artificial Intelligence will remain a viable investment thesis – though we believe this will shift to those companies who successfully integrate AI into their businesses in order to improve efficiencies, drive down costs, and/or increase revenues. Therefore, we also hold select names in the Materials, Energy, Information Technology, and Communications Services sectors, as well as Industrials.

A key component of our investment process is the overlay of structural thematic filters. These are long-term views developed by the Investment Team based on global economic data. They are tantamount to the portfolio construction process as they drive the sectors in which we invest, as well as the weightings of those sectors. Over the last 25 years, the average growth rate of U.S. GDP has been 2.5%. Over the last 10 years, that number has been below 2%. The Investment Team believes that tepid economic growth will continue. Therefore, equity composites remain overweight sectors that do not rely on strong economic growth – sectors such as Consumer Staples, Health Care, and Utilities. Despite our growth expectations, the Team also believes that inflation will remain above the Fed’s 2% target driven by U.S. economic policy and that Artificial Intelligence will remain a viable investment thesis – though we believe this will shift to those companies who successfully integrate AI into their businesses in order to improve efficiencies, drive down costs, and/or increase revenues. Therefore, we also hold select names in the Materials, Energy, Information Technology, and Communications Services sectors, as well as Industrials.

In closing, while we as an investment manager cannot control what the markets will do over the next 25 years, we can control our investment process. The Investment Team continues to build portfolios that are focused on generating strong risk-adjusted returns by capitalizing on a successful investment process, deep intellectual capital, and lengthy experience.

We encourage you to contact your MAP representative with any questions or concerns.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, Zachary Fellows, John Dalton, and Nicolas Vilotti

May 21, 2025

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent a recommendation by us to buy or sell a particular security or any other financial instrument associated with it. Managed Asset Portfolios, our clients, and our employees may buy, sell, or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change. This content should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice. All investments are subject to risk, including the loss of principal. Past performance is no guarantee of future results. Managed Asset Portfolios, LLC claims compliance with the Global Investment Performance Standards (GIPS®). A list of composite descriptions, a list of broad distribution pooled funds and performance results are available upon request. Results are based on fully discretionary accounts under management, including those accounts no longer with the firm.