Artificial Intelligence (AI): A Secular Shift

May 22, 2023Until the release of ChatGPT (Generative Pre-trained Transformer) in late 2022, artificial intelligence (AI) developments largely flew under the radar. Although AI has existed in some form since the 1950s, it was perhaps more prominently featured in science fiction than in the everyday lives of Americans. However, the advent of ChatGPT has altered that outlook - the innovative bot can write everything from college essays, computer code, and even recently passed a Bar examination. However, it's important to remember that this is only the beginning - not too long ago, another wildly innovative and promising technology offered similarly transformative potential, and our lives haven't been the same since.

The internet had been researched for decades before finally coming into existence in the late ‘80s. However, it still took a while before the technology was affordable and useful to the average American. Once the internet took off in the mid to late ‘90s, new multi-billion dollar startups sprouted up, and investors rushed to capitalize on the momentum, hoping to get in on the technological revolution. A lucky investor may have stumbled onto a company like Amazon, which started as a convenient alternative to Barnes & Noble or Borders Group. But for every Amazon, handfuls of innovative companies never panned out. Take eToys, one of the most popular online toy retailers, during the dot-com boom. Their stock was selling for $84 per share in 1999, and just two years later, they were trading below 10¢ per share, declaring bankruptcy shortly after. Webvan, Yahoo, Netscape, and countless other tech startups showed plenty of promise but ultimately shared similar fates. In fact, investors who bought into the tech-heavy NASDAQ at its peak in March of 2000 would need to wait fifteen years just to break even. It's difficult to predict the winner of a horse race because, ultimately, the result is determined by a set of unknown variables. And for investors, it might be better to avoid betting on the race entirely and just buy a stake in the racetrack.

Sticking with the metaphor, the betting favorite of the AI horse race is Microsoft, which owns a stake in OpenAI, the creators of ChatGPT. Alphabet isn't far behind with Google Bard, and the rest of the pack is filled with a mix of innovative startups and established tech juggernauts like Meta, Amazon, and IBM. For the racetrack part of the analogy, AI and, more specifically, large language models (LLMs) require immense computational power. This has two outcomes. Large companies like Amazon, Google, Microsoft, and Meta can afford to spend billions of dollars building the required servers and data centers to train and host these models. For everyone else, they are going to require these same companies to host the models, and companies will access them via the cloud. Either way, both result in more data centers being built.

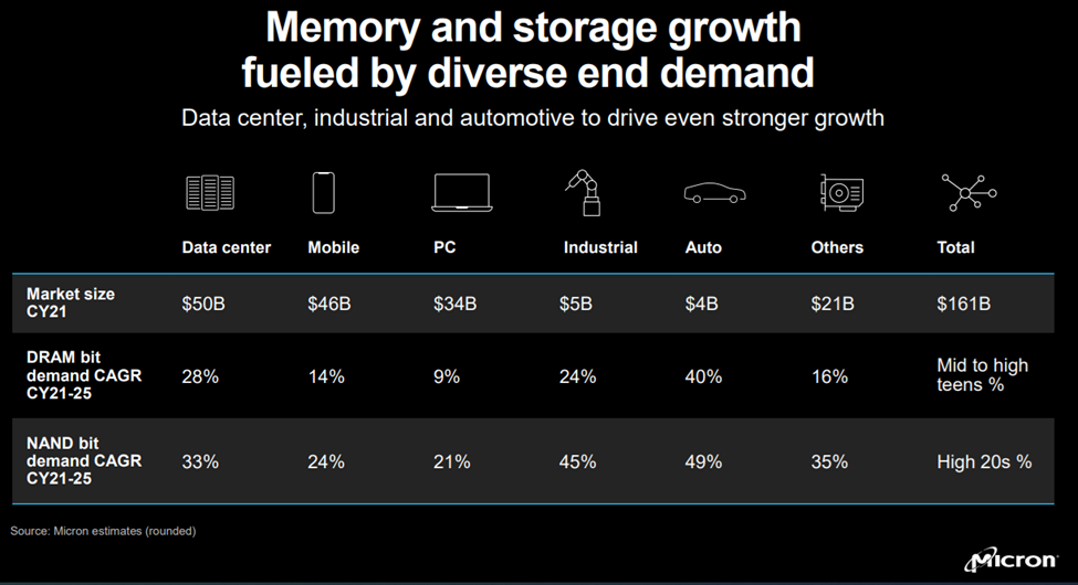

These data centers are hardware intensive and comprise graphics cards, processors, short-term memory, and storage. Graphics Processing Units (GPUs) are critical because they are necessary for training large models due to their parallel computing capabilities. This computing/training is still somewhat limited by transfer speeds, which is where Dynamic Random-Access Memory (DRAM) makes its entrance as one of the best options to increase training and inference speed, which will likely be critical for commercial success. Non-volatile Storage (NAND) has the potential to benefit as AI is incorporated into more everyday systems like driving, increasing the amount of data storage required. The graphic below from Micron's investor day supports this idea, projecting growing demand for DRAM and NAND, with data centers projected to see 28% and 33% annual compounded increases in demand, respectively.1

Huge models like GPT-4 and Google's Parallel Language Model-2 aren't the only ones being pushed; smaller models are being dispersed to client devices like smartphones. It's not unreasonable to believe that you could have an AI model on your iPhone or iPad in the near future. AI will also end up in many industrial industries like manufacturing and autos as companies push driverless technology and automation advancements. While the projections below are for DRAM and NAND, we think they represent the benefits from AI that could accrue to the entire semiconductor supply chain, from the designers of chips to the manufacturers of wafer fab equipment. There's no telling how far artificial intelligence will come in five- or ten-years time. Nor is there a way to determine which company or companies will hit the AI sweepstakes, but one thing is all but guaranteed - as AI continues to develop, demand for semiconductors and the equipment used to manufacture them will increase.

AI will undoubtedly be a revenue driver for software and hardware companies, but it will also have the potential to revolutionize industries outside the technology space. Companies have been looking to make their operations more productive through new software and automation for decades. However, in many cases, service industries were limited in the type of gains they could achieve due to their significant dependence on labor. AI, automation, computer vision, and a host of other technologies are finally offering ways to optimize their labor force and make their labor more productive. Depending on how you view AI, it will likely tilt your view as to which one it does more of. However, a prime example of the latter is Walmart, which has a huge employee base, low margins, and many operations that have been maxed out regarding previous technology implementations. Their management recently stated that they see AI and automation as their most significant business opportunity since the rollout of the superstore, and they are moving full speed ahead.

They have already started deploying robots in regional distribution centers and in-store warehouses while leveraging AI systems like GPT-3 on internal systems. To highlight the speed at which they are moving, they currently project that by the end of 2026, 65% of stores will be automated to some degree and that 55% of fulfillment center volume will move through automated facilities, leading to a whopping 20%-unit cost reduction.2

The potential disruption from AI doesn't stop at cashiers and store greeters – nearly 20% of the U.S. workforce could complete their tasks much faster with AI, and around two-thirds of jobs will have their definitions redefined.3 Those significant estimates are partly due to the rapid evolution of ChatGPT. For instance, the original model (GPT 3.5), launched in November of 2022, scored 213/400, ranking in the 10th percentile. GPT-4, released about four months later, passed the Bar with a 298/400, scoring in the 90th percentile. While it won't be working on high-profile cases, it's entirely possible that AI could handle simple divorces, wills, or other basic legal documents. AI's uncanny ability to process troves of information in seconds has also proved helpful in the healthcare industry. AI is already being used to read X-Rays and to help psychiatrists provide therapy to patients. On the other side of the equation is AI's ability to solve longstanding roadblocks in the search for new life-saving drugs and treatments. One example is Google's DeepMind which uses machine learning to solve protein structures and mappings in seconds when it would traditionally take years for just one. DeepMind solved 200 million structures last year, whereas it would have taken an estimated one billion years to solve them using traditional methods. Through this, DeepMind made all the protein structures publicly available, an enormous leap for the progress of human biology.4

Summary

The development of ChatGPT marks a turning point for artificial intelligence, bringing it out of the realm of sci-fi and into our everyday lives. However, just like the dot-com boom of the ‘90s, it's difficult to predict which AI companies will succeed and which will fail. Investors may benefit more from focusing on the hardware and semiconductor industries, as the increasing demand for data centers and computing power will drive growth in those areas. AI also presents opportunities for corporations to cut costs through automation, which is already being implemented by companies like Walmart. As AI continues to develop, it's clear that it will have a significant impact on both the tech industry and the wider economy.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

May 2023

1https://investors.micron.com/events/event-details/micron-investor-day-2022

3https://arxiv.org/pdf/2303.10130.pdf

Certain statements may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein does not represent a recommendation by us to buy or sell any security or securities. Managed Asset Portfolios, our clients and our employees may buy, sell or hold any or all of the securities mentioned. The summary of this thought piece was generated by ChatGPT. We are not obligated to provide an update if any of the figures or views presented change. Past performance is no guarantee of future results.