Beyond the Green: Examining MAP’s Outlook for the U.S. Dollar

Nov 05, 2025

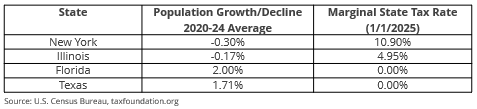

Many years ago, MAP’s President & Chief Investment Officer Michael Dzialo’s mentor would always say to him: “money goes where it’s respected.” We are seeing this play out in today’s markets in several ways. Citizens of high tax jurisdictions such as New York and Illinois are moving to states with lower taxes - states such as Florida and Texas, for example. The table above illustrates this point, as the states with the greatest population losses tend to have the highest tax burdens, while those with the greatest population gains tend to have more friendly tax environments.

Let’s expand this thought process to a global footprint. Last year marked the peak of U.S. exceptionalism. The S&P 500 and the NASDAQ 100 ripped higher, fueled by Artificial Intelligence (A.I.) stocks. The U.S. dollar was trouncing other currencies, while U.S. stocks trounced most other geographies, making the U.S. a fertile ground for foreign investors. This was a double bonus for foreign investors. Strong equity gains coupled with currency gains were the icing on the cake. Since COVID, European investors bought $8 trillion of U.S. equities while foreign owners increased their exposure to U.S. debt to over $9 trillion.

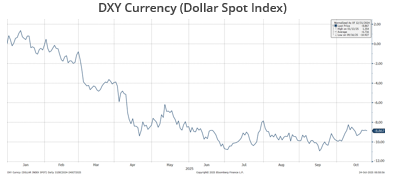

Hence, the largest export from the U.S. became financial assets. As an example, the Government Pension Investment Fund of Japan owns almost 134 million shares of Nvidia and over 81 million shares of Apple, while the Kingdom of Sweden owns over 54 million shares of Nvidia and over 32.6 million shares of Apple. Even the Swiss National Bank had 93.5% of its assets invested in North America. This year, the investment landscape has changed. With the dollar depreciating about 10% versus most other currencies through the third quarter, foreign investors saw most of their U.S. stock market gains eliminated by the falling dollar.

This trend clearly played out in the financial markets. Most of the best performing investments were anti-dollar bets: foreign equities, foreign currencies, gold, silver, platinum and even cryptocurrencies. Typically, large asset allocators and sovereign wealth funds only rebalance their portfolios annually. As such, we suspect that U.S. dollar investments will receive smaller allocations in 2026.

Given this move in the U.S. dollar relative to other currencies, investors need to ask themselves: “How does the Trump administration accomplish its goals with a strong dollar?” In our opinion, the answer is they cannot. The dollar declined under Trump 1.0 and, so far, it continued to do so under Trump 2.0. History has shown that much larger drawdowns can occur. From 2000 – 2007, the greenback tumbled 40%, while the five-year period following the signing of the Plaza Accord in 1985 saw the greenback fall by nearly 50%. It is worth noting that during both periods, foreign stock performance outpaced U.S. stocks by nearly a 2-to-1 margin. While we believe the current administration wants to support American competitiveness through dollar weakness, we do not expect this movement to occur in a straight line. Furthermore, we do see two potential scenarios where we could see significant dollar strength. These include a significant increase in geopolitical risk and a market rerating into a ‘risk-off’ environment.

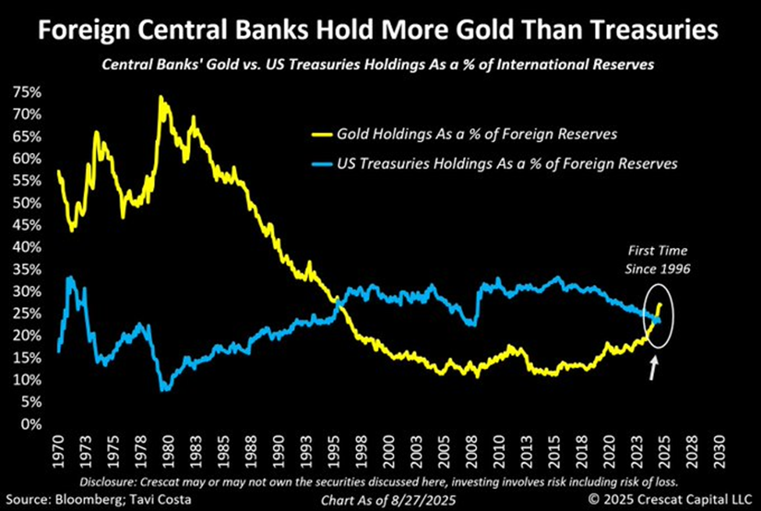

Precious metals, paced by gold, have been a shining standout this year on the investment stage. For years, investors have broadly frowned upon gold as an asset, but today it is a very different story. Once a relegated asset class, today the precious metal is making investment headlines. The rise has been fueled by not only global Central Banks, but also by individuals across the world. As shown in the graphic below, Central Banks now own more gold than they do U.S. Treasuries.

As our clients know, we have viewed gold as a key part of our investment strategy for many years. We concede that the price has come a long way over a relatively short timeframe. As such, we would not be surprised to see a near-term pullback. Due to the stout appreciation the asset has experienced, we may trim some outsized positions as part of prudent portfolio management. Even though we may trim some of our larger positions, we continue to view gold favorably over the intermediate to longer-term as insurance against continued dollar weakening.

Please feel free to reach out to your MAP representative with any questions or concerns.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, Zachary Fellows, John Dalton, and Nicolas Vilotti

November 5, 2025

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent a recommendation by us to buy or sell a particular security or any other financial instrument associated with it. Managed Asset Portfolios, our clients, and our employees may buy, sell, or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change.