An Investor's Cookbook - The Secret Sauce

Jan 27, 2026In December, we published a press release detailing the Lipper Broadridge - Best Managers rankings for our U.S. Multi-Cap Value strategy. Since publication, we have received several questions asking how we achieved this recognition and what our ‘secret’ is. With this in mind, we decided to publish this thought piece.

Recipes are important because they provide a blueprint for successful cooking, ensure consistency, and serve as a valuable learning tool. As an investment advisor, the same holds true. Below are the main ingredients of the Investment Team’s recipe.

Skepticism and curiosity are often an analyst’s greatest assets. Far too often, investors get caught up in the hype of a good story while ignoring core metrics. During the dot-com bubble, some analysts and investors created new ways to value a company’s stock price, citing ‘eyeball views’ and ‘clicks’ as compelling reasons to invest. There will never be a substitute for using revenues, earnings, and cash flows as a foundation for valuing a stock. After being burned in the crash of the dot-coms, investors moved on to embrace real estate. How many times during the real estate bubble did you hear: “You can’t lose money in real estate”? Along came 2008, and we all know how that story ended.

While the Artificial Intelligence movement is certainly real and the technology will likely accomplish tasks not even conceivable today, once again, investors have thrown fundamentals to the side in favor of a good story. As an example, OpenAI had approximately $12 billion in revenue last year and a projected $20 billion in 2026. While impressive, it does not logically explain how they will cover the company’s $1.4 trillion in financial obligations. To illustrate how extreme this is, it is the equivalent of someone earning $40,000 a year attempting to buy a $2.8 billion home.

Diversification is key for any portfolio, but conviction is crucial for long-term, active managers. We typically hold between 25 and 40 stocks in our U.S. Multi-Cap Value strategy. We believe this range is optimal, as it provides for diversification, without diluting our best investment ideas. We allocate more to our highest-conviction ideas. The goal of active management is to outperform the benchmark with less risk—something that becomes nearly impossible when holding hundreds of names. This is why so many active mutual funds underperform their benchmarks. It is hard to beat the index when the portfolio mimics the index.

Patience is key. We think like a business owner rather than a trader. This recipe is designed to be used repeatedly across various market cycles. Success is measured not by short-term performance, but by achieving long-term growth while preserving capital during market drawdowns. Our average annual turnover over the last decade is approximately 36%. Less trading translates into lower trading costs and most importantly, increased tax efficiency.

Conviction and confidence are essential, but humility is equally important. Not every stock selection will work out. When the fundamentals change, or the catalyst behind our purchase disappears, we look for an exit point. This is the difference between confidence and arrogance. Managing a portfolio is challenging; every time you place a trade, someone on the other side believes you are wrong. Conviction matters—but arrogance destroys.

In the end, successful investing is less about finding a secret ingredient and more about consistently following a sound recipe over time. Patience allows us to look beyond short-term noise, conviction gives us the confidence to act when opportunities arise, humility reminds us that markets are complex and ever changing and realism keeps expectations grounded in fact rather than emotion. These principles have guided our decisions for 25 years across a wide range of market environments and have helped us remain disciplined.

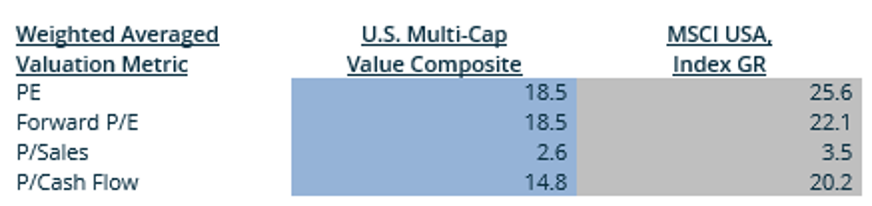

The U.S. Multi-Cap Value strategy offers more attractive average valuation levels relative to its benchmark across several key measures. On a price to earnings basis, the strategy currently reflects a disciplined selection of companies whose earnings power we believe remains underappreciated. Likewise, the strategy’s price to sales ratio and price to cash flow ratio indicate that we are paying materially less for each dollar of revenue and cash generated than what is implied by the broader index. Together, these valuation metrics underscore our commitment to identifying fundamentally strong businesses at reasonable prices—an approach that we believe continues to provide a meaningful margin of safety and strong long term return potential relative to the benchmark.

Data as of 12/31/2025. Composite-specific descriptive statistics derived from holdings based on the aggregate of individual portfolios in the composite, as calculated by Bloomberg. Holdings of individual client portfolios in the composite may differ, sometimes significantly, from those shown. Benchmark data as of 12/31/2025, as calculated by FactSet Market Aggregates. The information provided is supplemental and complements the MAP U.S. Multi-Cap Value Composite GIPS® Report.

We are grateful for the trust you place in us and for the partnership we share. Your willingness to stay committed to this approach has been an essential part of our collective success. We remain focused on applying these same core principles as we look ahead, confident that a disciplined, risk-aware process and long-term perspective should continue to serve your financial goals well.

As always, we appreciate the opportunity to successfully navigate an ever-changing future together.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, Zachary Fellows, John Dalton, and Nicolas Vilotti

January 27, 2026

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent a recommendation by us to buy or sell a particular security or any other financial instrument associated with it. Managed Asset Portfolios, our clients, and our employees may buy, sell, or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change.